Gold Rate Today UAE

The United Arab Emirates (UAE), a dynamic and cosmopolitan country, is globally recognized as a prominent center for gold trade. Among its cities, UAE stands out as a thriving hub for gold enthusiasts. Renowned for its strategic location, world-class infrastructure, and investor-friendly policies, Dubai has established itself as an ideal destination for gold trading. While the city’s gold rates are influenced by international market trends, one of its key advantages is the absence of value-added tax (VAT) on gold, making it highly appealing for buyers and sellers.

Dubai’s tax-free status on gold imports and exports contributes significantly to its competitive pricing structure. Additionally, the city’s multicultural environment and rich tradition of gold craftsmanship make it a preferred choice for those seeking exquisite and intricate gold jewelry designs. Presently, in Dubai, the gold rate stands at AED 233.50 or Rs. ₹5,317.70 per gram for 24 Karats and AED 216.25 or₹4,832.24 for 22 Karat, making it an alluring destination for investors and individuals looking to indulge in the luxury of gold. The UAE’s gold trade continues to thrive, bolstered by Dubai’s favorable policies and its status as a global hub for the precious metal.

Gold Rate Today UAE

| 5th February 2024 | 1 gram | 8 grams | 10 grams | 12 grams (1 Tola) | 100 grams |

| 24 Carat Gold (Pure Gold Rate) | AED 233.50 +0.00 | AED 1,868 +0.00 | AED 2,335 +0.00 | AED 2,802 +0.00 | AED 23,350 +0.00 |

| 22 Carat Gold (Standard Gold Rate) | AED 216.25 +0.00 | AED 1,730 +0.00 | AED 2162.50 +0.00 | AED 2595 +0.00 | AED 21,625 +0.00 |

Gold Rate Today UAE

| 5th February 2024 | 1 gram | 8 grams | 10 grams | 12 grams (1 Tola) | 100 grams |

| 24 Carat Gold (Pure Gold Rate) | ₹5,217.70 +0.00 | ₹41,741.58 +0.00 | ₹52,176.98 +0.00 | ₹62,612.40 +0.00 | ₹5,21,770 +0.00 |

| 22 Carat Gold (Standard Gold Rate) | ₹4,832.24 +0.00 | ₹38,657.89 +0.00 | ₹48,322.36 +0.00 | ₹57,986.88 +0.00 | ₹4,83,224 +0.00 |

* The above-mentioned gold rates are approximate and do not include GST or other additional charges. To obtain precise rates, please consult your local jeweller.

Gold Rate Today in UAE

| Quantity | 24K Gold (Today) | 24K Gold (Yesterday) | Gold Price Movement = (Today) – (Yesterday) |

| 1 gram | ₹5,217.70 | ₹5,217.70 | +₹0.00 |

| 8 gram | ₹41,741.58 | ₹41,741.58 | +₹0.00 |

| 10 gram | ₹52,176.98 | ₹52,176.98 | +₹0.00 |

| 12 gram | ₹62,612.40 | ₹62,612.40 | +₹0.00 |

| 100 gram | ₹5,21,770 | ₹5,21,770 | +₹0.00 |

* The above-mentioned gold rates are approximate and do not include GST or other additional charges. To obtain precise rates, please consult your local jeweller.

Factors that Affect Gold Rate

Gold prices are influenced by a multitude of factors, both global and local. Understanding these factors is crucial to comprehend the fluctuations in gold rates in UAE. One of the primary drivers of gold prices is global economic indicators. When the economy is strong, investors may shift their focus to riskier assets, leading to a decrease in gold demand and subsequently lower gold prices. On the other hand, during times of economic uncertainty or geopolitical tensions, investors often seek the safe haven of gold, driving up its price.

Another factor that affects gold rates in Dubai is the strength of the Indian rupee. Since gold is traded internationally in US dollars, any changes in the value of the rupee against the dollar can impact gold prices. If the rupee depreciates against the dollar, the cost of importing gold increases, leading to higher gold rates in UAE.

Additionally, the demand and supply dynamics within Dubai s gold market play a significant role in determining gold rates. Factors such as festive seasons, weddings, and cultural preferences for gold jewelry can drive up the demand for gold, causing prices to rise. Conversely, if there is a surplus of gold in the market or a decrease in consumer demand, gold rates may decrease.

Understanding these various factors provides valuable insights into why gold rates fluctuate and allows investors and buyers to make informed decisions based on market conditions.

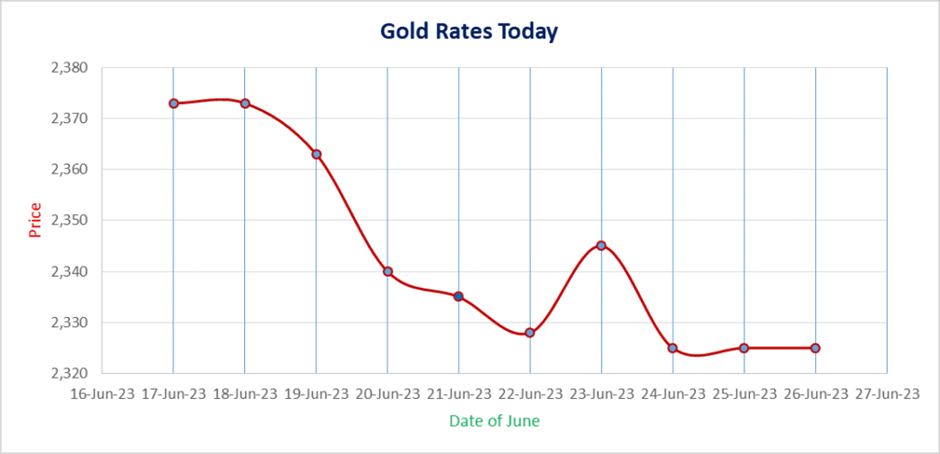

Historical Trends of Gold Rates in UAE

Historical gold rate trends provide valuable insights into the gold market in UAE. In recent years, the gold rate in UAE has displayed an upward trajectory. For instance, in 2018, the gold rate was approximately Rs. 31,000 per 10 grams, and by 2020, it had surpassed Rs. 48,345 per 10 grams. The COVID-19 pandemic significantly contributed to the surge in gold prices as investors sought the stability of gold during uncertain times.

However, in 2021, the gold rate in UAE experienced a slight decline compared to the previous year. In January 2021, the gold rate stood at around Rs. 48,500 per 10 grams, indicating a decrease from the previous year’s peak. Several factors, such as the global vaccine rollout, the gradual stabilization of the economy, and rising interest rates, have influenced the drop in gold prices. However, it’s important to note that the gold rate in UAE has shown fluctuations in recent months, emphasizing the need for individuals to stay updated on the latest trends.

Pros and Cons of Buying Gold in UAE

Buying gold in UAE, like any other city, has its own set of advantages and disadvantages. Let’s explore the pros and cons of investing in gold in the UAE:

Pros of Buying Gold in UAE:

- Cultural Significance: UAE holds a deep-rooted cultural significance for gold. The metal is an integral part of traditions, festivals, and celebrations, making it readily available and highly valued in the city.

- Active Gold Trade: UAE boasts a thriving gold market, thanks to its status as one of the largest importers of gold in India. This active trade ensures a wide variety of gold options, including jewelry, coins, and bars, catering to diverse consumer preferences.

- Competitive Prices: Due to different tax policies and local market factors, the price of gold in UAE may vary slightly compared to other regions. This can sometimes result in more competitive prices, attracting buyers looking for favorable deals.

- Jewelry Craftsmanship: UAE is renowned for its skilled artisans and craftsmanship in gold jewelry. Buyers have access to exquisite designs and intricately crafted pieces, allowing them to choose from a wide range of stunning jewelry options.

- Investment Hedge: Gold has long been considered a safe-haven investment during economic uncertainties. It serves as a hedge against inflation and currency fluctuations, providing stability and security to investors.

Cons of Buying Gold in UAE:

- Fluctuating Gold Rates: While the local economy and tax policies influence gold prices in Dubai, the metal’s value is primarily driven by international and national market trends. These fluctuations can make it challenging for buyers to time their purchases and may result in potential price volatility.

- Storage and Security: Gold is a valuable asset that requires proper storage and security. Purchasing significant quantities of gold in Dubai means ensuring appropriate measures to safeguard it from theft or damage. This can involve additional costs and efforts for buyers.

- Making Charges and Wastage: When buying gold jewelry, customers often incur additional charges such as making charges and wastage, which can increase the overall cost. It is essential to consider these factors while evaluating the value for money in gold purchases.

- Limited Liquidity: While gold is a liquid asset, selling it may involve certain complexities, particularly if the buyer intends to sell it back to the same jeweler. Buyers may face challenges in finding the right buyer and getting a fair price, impacting the ease and liquidity of their gold investments.

- Risk of Counterfeit Products: With the popularity of gold in Dubai, the risk of counterfeit products also exists. Buyers must be vigilant and ensure they purchase gold from trusted and reputable jewelers to avoid falling victim to fraudulent practices.

Is it the Right Time to buy or Sell Gold in UAE?

The decision to buy or sell gold in UAE can be a challenging task as the gold market is influenced by various factors. While it is impossible to predict the market with absolute certainty, considering certain aspects can help in making an informed decision:

Buying Gold in UAE:

- Market Conditions: Monitor the overall market conditions, including global economic trends, geopolitical factors, and central bank policies. These factors can impact the demand and price of gold. If the market is experiencing a downward trend or shows signs of stabilization after a decline, it may be a favorable time to consider buying gold.

- Gold Price Levels: Keep an eye on the gold price levels and analyze whether they align with your budget and investment goals. Study the historical price movements and evaluate if the current price is relatively low or at a reasonable level. However, it’s important to remember that trying to time the market perfectly can be challenging, so it’s often advisable to take a long-term perspective.

- Market Sentiment: Pay attention to the market sentiment surrounding gold. Market sentiment reflects the overall perception and confidence of investors. If there is pessimism or uncertainty prevailing in the market, it could lead to a decrease in gold prices, presenting a potential buying opportunity.

Selling Gold in UAE:

- Gold Price Performance: Evaluate the performance of gold prices over time. If the price has significantly appreciated and reached a level that aligns with your profit goals, it may be a suitable time to consider selling. However, it is important to balance the desire for profit with the understanding that gold is also a long-term investment and can serve as a hedge against inflation.

- Financial Needs and Goals: Assess your financial needs and goals. If you require immediate funds for a specific purpose or have identified other investment opportunities with potentially higher returns, it may be appropriate to sell a portion of your gold holdings. However, ensure that you maintain a diversified investment portfolio and consider the long-term value of gold as a wealth preservation asset.

- Market Outlook: Stay informed about the market outlook for gold. Follow expert analysis, market forecasts, and economic indicators that can provide insights into the future direction of gold prices. If there are indications of a potential decline in gold prices, it may be prudent to sell before the market downturn.

Where to Buy Gold in UAE and Important Considerations?

UAE is home to a vast number of jewelry stores and gold retailers, offering a wide range of options for buyers. When it comes to purchasing gold in UAE, it is crucial to consider certain factors to ensure a safe and satisfactory buying experience.

Firstly, it is advisable to buy gold from reputed and trusted jewelers. Look for jewelers who are members of recognized industry associations and have a long-standing reputation for quality and authenticity. This helps minimize the risk of purchasing counterfeit or substandard gold.

Secondly, consider the purity of the gold. Gold is typically measured in karats, with 24 karats being the purest form. The purity of gold influences its price, with higher-purity gold commanding a premium. Ensure that the gold you purchase is certified and hallmarked by a recognized assaying center to guarantee its purity.

There is another option to invest in ETF or Exchange-Traded-Funds. Gold ETFs are definitely one of the best investment methods to trade on the stock market and track the price of gold investments. Investing in gold ETFs can give a more liquid and hassle-free option for investors.

In the end, there are online platforms that provide digital gold which is a convenient and cost-effective method to invest in gold. Digital gold permits investors to purchase and sell gold in small chunks. It will make gold accessible to a larger audience.

Selling Gold in UAE – The Best Options and Tips

When it comes to buying and selling gold in UAE, it’s essential to approach the market with knowledge and careful consideration. Here are the top five tips to keep in mind:

- Research and stay informed before engaging in any gold transaction, and educate yourself about the gold market in UAE. Stay informed about current gold prices, market trends, and factors influencing the gold market. Follow trusted financial news sources, consult reputable jewelers or gold dealers, and consider seeking advice from financial professionals. This research will help you make informed decisions and navigate the market effectively.

- Verify the purity and authenticity, while buying gold, especially jewelry, and ensure that you are purchasing from trusted sources. Check for appropriate certifications and hallmarks that indicate the purity of the gold. In India, BIS (Bureau of Indian Standards) hallmarking is widely recognized, and it guarantees the quality and purity of gold. When selling gold, consider getting an appraisal from a trusted source to assess its value accurately.

- Making charges are the fees for the labor and craftsmanship involved in creating the jewelry piece, while wastage accounts for the gold lost during the manufacturing process. It’s important to understand these charges and negotiate them when purchasing jewelry. When selling gold jewelry, these charges may not be recoverable, so factor them into your decision.

- Timing is crucial when buying or selling gold. Monitor the market for price fluctuations and consider the overall trend. While it’s challenging to time the market perfectly, you can take advantage of lower prices during market dips to buy gold and capitalize on higher prices during market upswings to sell. However, it’s important to focus on the long-term value of gold as an investment rather than trying to predict short-term market movements.

- Assess your risk tolerance and decide the proportion of your portfolio that should be allocated to gold. Consider factors like liquidity needs, time horizon, and diversification. A well-balanced and diversified portfolio is key to managing risk effectively.

- Choose reputable jewelers or gold dealers who have a long-standing presence in the market and a reputation for fair pricing and quality products.

- Understand the terms and conditions of any gold purchase or sale, including return policies, buyback options, and documentation requirements.

- Compare prices and negotiate when buying gold to ensure you get the best possible deal.

- Safeguard your gold purchases by storing them securely in a bank locker or a trusted vault to minimize the risk of theft or loss.

- Keep track of your gold investments and periodically review their performance to assess their contribution to your overall financial goals.

- Consider investing in gold ETFs or digital gold for a more convenient and hassle-free option.

Tips Before Investing in Gold in UAE

Investing in gold can be a lucrative option for individuals looking to diversify their investment portfolio or hedge against economic uncertainties. However, before diving into gold investments in UAE, it is essential to consider certain factors.

1. Risk tolerance: Like any investment, gold carries its own set of risks. The price of gold can be volatile, and market conditions can fluctuate rapidly. It is important to assess your risk tolerance and determine how much exposure to gold you are comfortable with.

2. Investment objectives: Clarify your investment objectives before investing in gold. Are you looking for long-term wealth preservation, capital appreciation, or short-term gains? Understanding your goals will help you choose the appropriate investment vehicles and strategies.

3. Allocation of funds : Determine the percentage of your overall investment portfolio that you want to allocate to gold. Financial experts generally recommend allocating around 5% to 10% of your portfolio to gold, depending on your risk appetite and investment goals.

4. Investment options : UAE offers various investment options for gold, including physical gold (jewelry and bullion), gold exchange-traded funds (ETFs), gold mutual funds, and gold savings schemes. Each investment option has its own set of advantages and considerations. Research and evaluate these options to choose the one that aligns with your investment objectives.

5. Costs and fees: Consider the costs associated with gold investments, such as making charges, storage fees, management fees (for ETFs and mutual funds), and exit loads. These costs can impact your overall returns, so it’s important to factor them into your investment decisions.

6. Tax implications: Understand the tax implications of investing in gold. In India, gold jewelry is subject to wealth tax, while gains from gold investments are subject to capital gains tax. Familiarize yourself with the tax rules and consult a tax professional if needed.

Gold Investment Options Other Than Physical Gold

Investors have several options to invest in gold beyond physical ownership:

- Gold Exchange-Traded Funds (ETFs): These funds track the price of gold and can be bought and sold on stock exchanges like shares.

- Gold Mutual Funds: These funds invest in gold-related assets such as mining company stocks or gold ETFs, offering diversification and professional management.

- Gold Mining Stocks: Investing in gold mining companies provides exposure to the mining industry’s growth and profitability.

- Gold Futures and Options: Experienced investors can trade gold futures and options contracts, speculating on future price movements.

- Gold Accumulation Plans: Investors can regularly invest fixed amounts to accumulate gold over time, held by banks or financial institutions.

- Gold Certificates: Issued by banks or financial institutions, these certificates represent ownership of a specific amount of gold without physical possession.

Conclusion on Gold Rate Today in UAE

In conclusion, the gold rate in UAE is influenced by various global and local factors. Staying informed about the trends in the gold market and keeping up with the latest gold rates is essential for investors in UAE. While purchasing gold in UAE offers its own advantages, it is crucial to carefully consider the associated risks and potential returns. Moreover, there are several alternative gold investment options available to investors, apart from physical gold. By following the tips and guidelines mentioned in this article, individuals in UAE can make well-informed decisions regarding their gold investments.

Read More: LATEST: Gold Rate Today at Bangalore as of 5th February 2024

FAQs

What is the gold rate today in UAE?

The gold rate today in UAE is AED 233.50 or Rs. ₹5,317.70 per gram for 24 Karats and AED 216.25 or₹4,832.24 for 22 Karats for 10 gms of 22 Carat Gold (Standard Gold Rate).