Samsung is preparing to launch its own credit card in the United States through a partnership with British bank Barclays, directly challenging Apple’s dominance in consumer finance. This strategic move aims to strengthen Samsung Wallet adoption and create a comprehensive financial ecosystem rivaling Apple’s payment services.

Table of Contents

Partnership Details and Timeline

According to The Wall Street Journal, Samsung and Barclays are in advanced negotiations to launch a Visa-backed credit card by the end of 2025. The partnership has taken longer than expected to finalize, but both companies remain committed to entering the competitive fintech market.

| Feature | Samsung Card | Apple Card |

|---|---|---|

| Banking Partner | Barclays (UK) | Goldman Sachs (switching to JPMorgan) |

| Payment Network | Visa | Mastercard |

| Launch Year | 2025 (expected) | 2019 |

| Cashback Integration | Samsung Wallet/Account | Apple Cash |

| Additional Services | Savings, BNPL, prepaid accounts | Savings account, BNPL |

Comprehensive Financial Ecosystem

Samsung isn’t stopping at just a credit card. The company plans to launch an entire suite of financial products to boost Samsung Wallet adoption:

High-Yield Savings Accounts: Competitive interest rates to attract deposits and deepen customer relationships.

Digital Prepaid Accounts: Accessible banking options for users preferring prepaid solutions over traditional credit.

Enhanced Buy Now, Pay Later: Improved installment payment options for Samsung products and partner merchants.

Cashback Rewards System: Rewards deposited directly into Samsung accounts for future purchases across Samsung’s ecosystem.

Strategic Motivation

As hardware innovation plateaus in the smartphone market, both Samsung and Apple are pivoting toward services and ecosystem lock-in strategies. Samsung’s financial push aims to create deeper brand loyalty by making it seamless to purchase phones, TVs, appliances, and other products using integrated financial tools.

Learning from Apple’s Playbook

The Apple Card launched in 2019 with Goldman Sachs and Mastercard, offering unlimited 2% cashback through Apple Pay, 3% at partner merchants, and interest-free financing on Apple products. Despite Goldman Sachs reporting significant losses and exploring an exit to JPMorgan, the card successfully strengthened Apple’s ecosystem.

Barclays’ US Market Expansion

For Barclays, this partnership represents a significant opportunity to expand its consumer lending footprint in the United States. The British bank gains access to Samsung’s massive Galaxy user base while leveraging the Visa payment network’s infrastructure.

Samsung’s Existing Financial Services

Samsung already operates successful financial products in other markets:

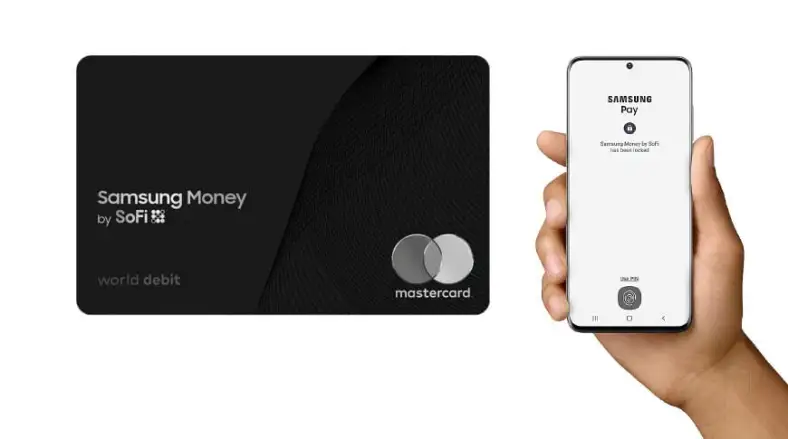

- South Korea: Samsung Pay Card launched in 2020 on Mastercard network

- India: Credit card partnership with Axis Bank since 2022

- UK: Digital Samsung Pay Card (2020)

This proven track record in international markets provides a foundation for US expansion.

Samsung Wallet Growth Strategy

Samsung Wallet has achieved strong adoption in South Korea but lags behind Apple Pay in the United States. The credit card and accompanying financial services aim to transform Samsung Wallet into a comprehensive digital payment hub that rivals Apple Pay’s dominance.

Broader Ecosystem Benefits

Unlike Apple’s focus primarily on consumer electronics, Samsung’s diverse product portfolio—including home appliances, TVs, refrigerators, washing machines, and kitchen appliances—creates unique opportunities. Cashback rewards can drive purchases across Samsung’s entire product ecosystem, not just smartphones.

Competitive Landscape Challenges

The credit card business carries significant risks. Goldman Sachs’ reported losses on Apple Card highlight the challenges of high growth rates and regulatory reserve requirements. Samsung and Barclays must navigate these financial service complexities while competing against established players.

Previous Attempts and Lessons Learned

Samsung explored similar partnerships with financial institutions in 2018, but those talks fizzled out due to skepticism about success prospects. Six years later, with proven international models and Apple Card validating the concept, financial institutions appear more willing to partner.

Expected Launch and Availability

While negotiations continue, both companies aim to announce the Samsung Card before year-end 2025. The initial launch will focus on the United States market, with potential expansion to other regions based on performance.

This bold move signals Samsung’s determination to compete with Apple not just on hardware specifications, but across the entire consumer technology experience—from devices to daily financial transactions.

Stay updated on the latest fintech developments and tech ecosystem strategies reshaping consumer technology.

Sources: Samsung Official | The Wall Street Journal