Union Budget 2024: The Tech Advantages Unveiled

Finance Minister Nirmala Sitharaman introduced policy initiatives to invigorate India’s technology and startup sectors in emerging areas during the presentation of the Union Budget 2024.

Union Budget 2024: Tech Advantages

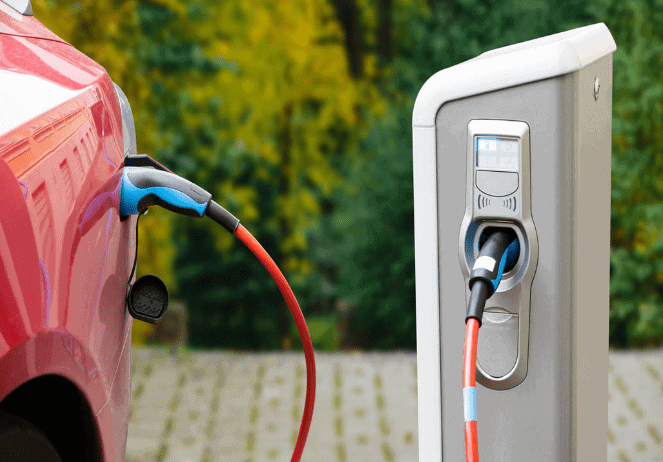

Boosting Electric Vehicle Infrastructure

Sitharaman committed to strengthening the vehicle (EV) ecosystem by supporting manufacturing and expanding charging infrastructure. Additionally, she outlined plans to promote the use of e-buses, for transportation while prioritizing payment security measures. Previous reports indicated the launch of an upgraded phase of the Faster Adoption & Manufacturing of Electric Vehicles (FAME) scheme with a budget allocation ranging from ₹10,000 to 12,000 crore.

Rooftop Solarisation Scheme

The government aims to assist around one crore households through the rooftop solarisation program, which will complement the development of vehicle charging infrastructure. Sitharaman announced that these households would be eligible for up to 300 units of electricity per month.

Tech-Savvy Youth Fund

Sitharaman disclosed intentions to establish a corpus fund ₹1 lakh crore offering a 50-year interest loan to support the growth of tech-savvy youth in India. This fund will enable long-term financing or refinancing at zero interest rates encouraging sector investments in research and innovation across emerging sectors.

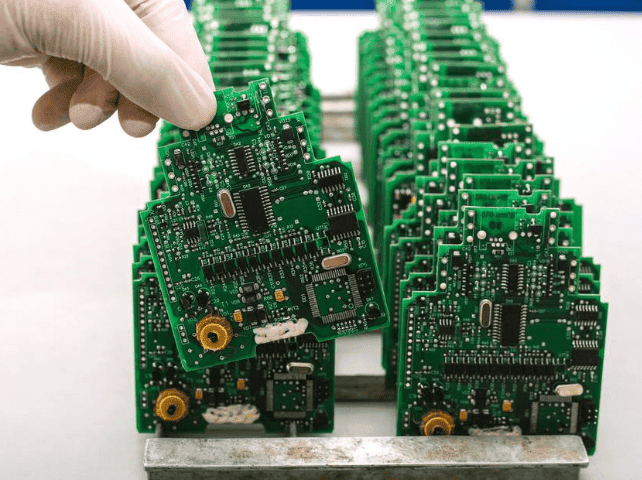

Hardware and Electronic Manufacturing Incentives

The government is striving to attract companies for investment in hardware and electronic manufacturing, within India. The government’s dedication to strengthening manufacturing is evident, through initiatives like the revived Indian Semiconductor Mission (ISM) and the second phase of the Production Linked Incentive (PLI) scheme, for IT hardware, which has a budgetary allocation of ₹17,000 crore.

Deep Tech Focus

A new scheme will be introduced to strengthen deep tech initiatives in the defense sector. Last year, a draft national deep tech startup policy was proposed, encompassing themes such as access to funding, intellectual property regime strengthening, and shared infrastructure facilitation.

Tax Benefits Extension

To ensure continuity in taxation, certain tax benefits for startups and investments made by sovereign wealth or pension funds, along with tax exemptions for specific income of International Financial Services Centre (IFSC) units, have been extended until March 31, 2025, from their original expiration date of March 31, 2024.