The unexpected closure of Silicon Valley Bank on Friday shocked the financial community when it was announced. Since Washington Mutual’s demise more than ten years ago, the collapse of the 16th-largest lender in the United States is thought to have been the worst bank disaster.

The Collapse of Silicon Valley Bank – Everything You Need to Know

The Biden administration, according to US Treasury Secretary Janet Yellen, is attempting to assist the depositors worried about their money but will not save the closed bank. Deposits are only covered up to a maximum of $250,000 by the Federal Deposit Insurance Corporation, although most businesses and wealthy clients of the bank had accounts far in excess of that amount.

Everything You Need to Know About the Collapse!

Around $21 billion in securities from the bank’s portfolio were sold on March 8th with the intention of reinvesting the proceeds, resulting in an after-tax loss of $1.8 billion for the first quarter. According to a report, the bank also disclosed offerings for its common stock for $1.25 billion and instruments representing convertible preference shares worth $500 million.

The SVB shares experienced their largest loss since 1998 on March 9, falling 41%. Its stock fell after SVB said that it had sold all of the securities in its portfolio that were on the market for sale and revised its annual outlook to represent a larger decline in net interest income.

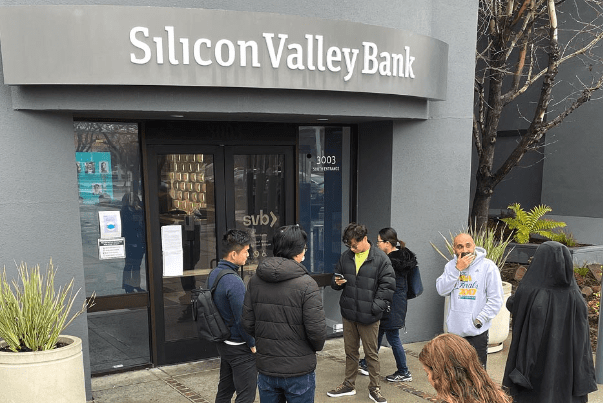

Greg Becker, CEO of SVB Financial Group, gave consumers advice to maintain composure amid worries about the lender’s financial situation. On March 10, well-known venture capitalists suggested that portfolio companies withdraw their funds from Silicon Valley Bank.

This occurred on a day when SVB shares were suspended following a significant decline in premarket trading. Before the bell, the stock was trading at $63.99, and if present declines persisted, it would open at its lowest price in more than a decade.

There have been recent developments that concern a few banks, which she is closely following, according to US Treasury Secretary Janet Yellen. According to Reuters, the Federal Deposit Insurance Corporation was named receiver after Silicon Valley Bank was closed by a California regulator. Following a 66% decline in premarket trading, the bank’s shares were suspended this day.