S B I Online Account Opening

If customers want to save money for the future and receive interest on their deposits, they can open a State Bank of India Savings Account. Consumers can choose to take advantage of the ease that comes with having a savings account by opening one at any of the more than 9,000 branches that are accessible to them.

S B I Online Account Opening

The State Bank of India offers the following kinds of savings accounts:

Motor Accidents Claim Account; Savings Bank Account; Instant Plus Savings Bank Account through Video Know Your Customer (KYC); Basic Savings Bank Deposit Account; Basic Savings Bank Deposit Small Account; Residence Foreign Currency (Domestic) Account

Regular Savings Bank Account with S B I

Applicants who apply for an SBI savings account are given the option to open a Regular Savings Bank Account. It is actually a simple savings bank account with a few features like credit cards, debit cards, SMS banking, internet banking, and more. For this account to be opened, a KYC document must be submitted.

To open a savings account, a PAN card is required for all federal, individual, and state government agencies.

Personalized debit card, RuPay ATM combination card, and debit card

Bank CardIn line with the terms and conditions

Deposit Book ServiceThe first ten check leaves are free during a fiscal year. After that, Rs. 40 + GST is required for ten leaf check books. Cost of a 25-leaf check book: Rs. 75 + GST

Extra ElementsSavings account with no balance:

• There is no minimum monthly average balance requirement; the account can be opened online.

• Internet and mobile banking capabilities • A nomination feature is offered

Small Savings Account SBI Basic

This savings account is intended for the less fortunate members of society who struggle to open bank accounts because they lack legitimate KYC documentation.

Balance, Minimum or Maximum: Minimum: NIL

The maximum is Rs. 50 lakh.

People over the age of eighteen who lack valid KYC documentation (self-atested photos or thumb impressions taken in front of an authorized branch officer)

ATM Fees Maximum Monthly WithdrawalThere can be a maximum of four withdrawals.

Basic RuPay ATM/debit card combination Credit card not available

Extra ElementsRs. 10,000 is the maximum transaction limit. Savings Account with No Balance Maximum credit amount available annually: Rs. 1 lakh for overseas remittances with a valid KYC account; these branches are part of the Corporate Account Group, Mid Corporate Group, Special Personalize Banking, and Personal Banking groups.

SBI Children’s Savings Account

The bank introduces the SBI Savings Account for Minors to the kids in an effort to teach them the value of money and saving. In addition, it helps students practice managing their finances in the future by allowing them to experiment with different purchasing power levels. Nonetheless, the parents and guardians should open and manage the account.

The Checkbook Facility

Pehla Kadam and Pehli Udaan, two checkbooksThe parent receives Pehla Kadam either alone or in tandem with the youngster. When a minor can sign consistently, they are given a Pehli Udaan. There is an option for an e-term deposit. An auto sweep feature is included.

Account SBI Savings Plus

The SBI Multi Option Deposit Scheme is the source of this product. A customer’s current or savings account is used under this savings account to open or connect a term deposit account. This fixed deposit account has a term of one to five years.

How to Open an Offline Savings Account at State Bank of India (SBI)?

In order to create an SBI savings account, clients must do the following procedures at any SBI Bank branch:

Step 1: Go to the SBI branch closest to you.

Step 2: Request an application to create a savings account.

Step 3: Complete the form in accordance with the guidelines.

Step 4: Complete form 2 if you do not have a PAN card.

Step 5: Fill out all the fields and send it in with the necessary KYC paperwork.

Step 6: Make a $1,000 minimum deposit.

Step 7: After the procedure is over, pick up your complimentary passbook and checkbook.

How to Open an Online Savings Account at State Bank of India:

The procedures listed below can be used to start an online savings account at State Bank of India.

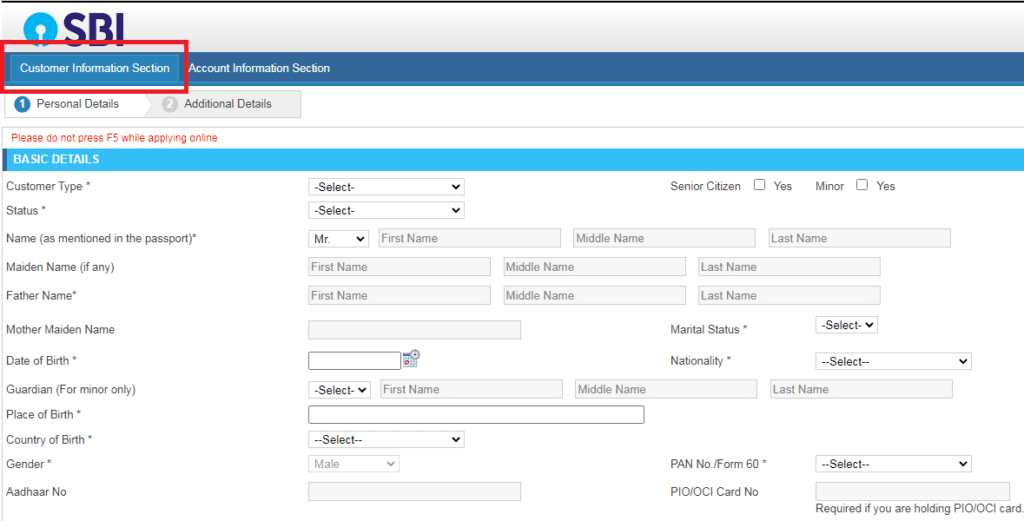

Step 1: Go to State Bank of India’s official website.

Step 2: Select the “Savings Account” option from the “Accounts” section.

Step 3: Select the “Apply” menu item.

Step 4: Fill out the application form with the necessary information, including your name, address, and date of birth.

Step 5: Select “Submit” from the menu.

Step 6: Bring the required KYC paperwork to the branch once this procedure is complete.

Step 7: Within three to five business days, SBI will start the verification process and activate your account.

Qualifications for Savings Accounts at State Bank of India

In order to be qualified to create a savings account with State Bank of India, clients must fulfill specific requirements:

• Need to be an Indian national.

• The applicant must be at least eighteen years old to be eligible.

• When a minor is underage, the minor’s parents or legal guardian may open the account on their behalf.

• The applicant must present government-approved proof of identity and address. • Upon bank approval, the applicant must make an initial deposit, which may vary based on the minimum balance necessary for the specific savings account that they have selected.

Read More: Tamil Movie Free Download: Get A Complete Guide to download new Tamil Movie