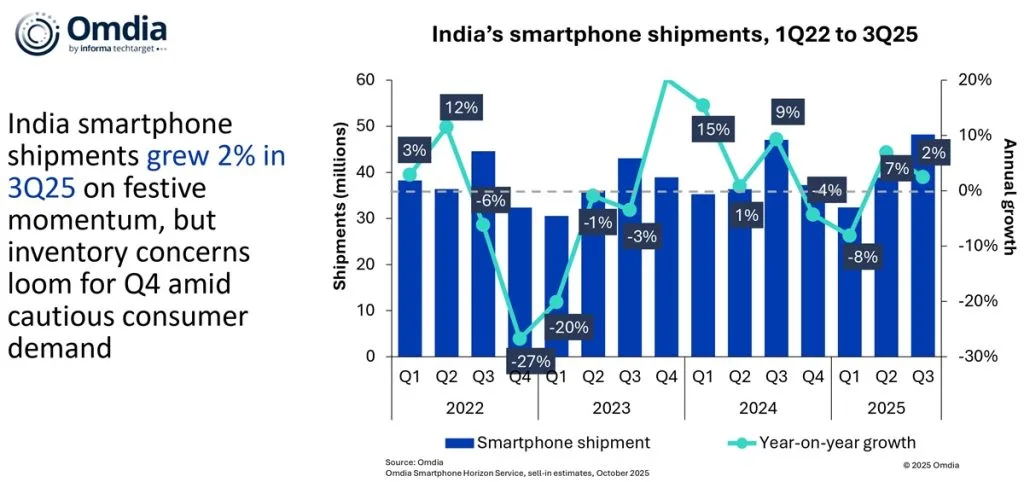

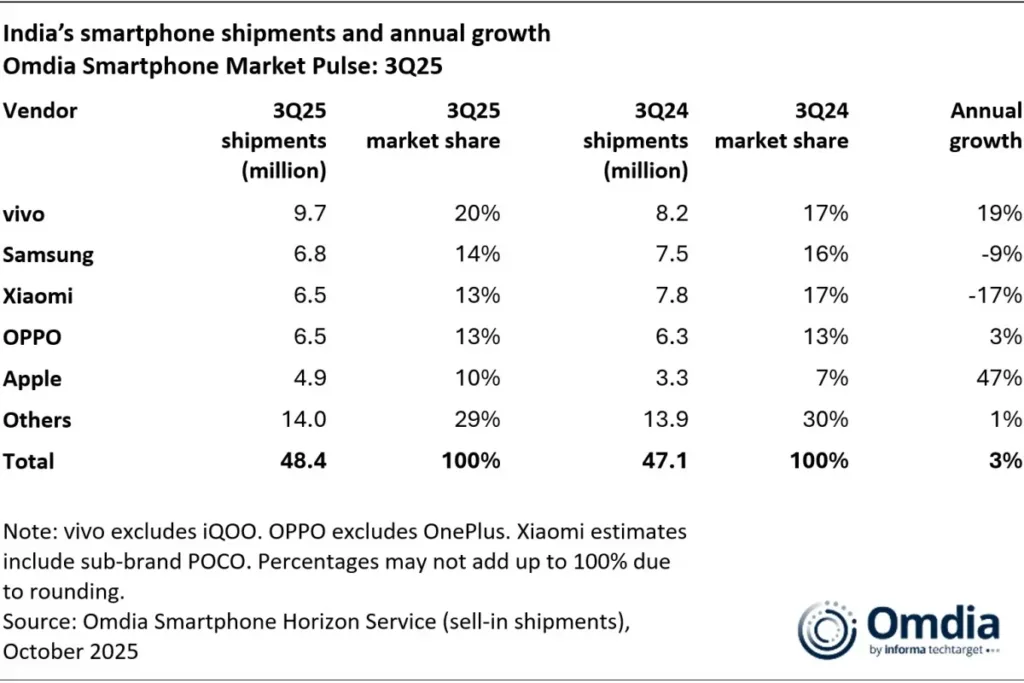

India’s smartphone market grew 3% year-over-year in Q3 2025, reaching 48.4 million shipments according to Omdia’s latest report. Vivo emerged as the undisputed leader with 20% market share (excluding iQOO), while Apple recorded an impressive 47% annual growth, and emerging players like Motorola and Nothing showed explosive triple-digit expansion.

Table of Contents

India Smartphone Market Q3 2025: Top 5 Brands

Market Share Breakdown (Q3 2025)

| Brand | Shipments (Million) | Market Share | Annual Growth |

|---|---|---|---|

| Vivo (excl. iQOO) | 9.7 | 20% | +19% |

| Samsung | 6.8 | 14% | -9% |

| Xiaomi (incl. POCO) | 6.5 | 13% | -17% |

| OPPO (excl. OnePlus) | 6.5 | 13% | +3% |

| Apple | 4.9 | 10% | +47% |

| Others | 14.0 | 29% | +1% |

| Total Market | 48.4 | 100% | +3% |

Performance Analysis

Vivo’s Dominance: With 9.7 million shipments and 20% market share (excluding iQOO sub-brand), Vivo leads India’s competitive landscape. If iQOO were included, the combined entity would widen the gap significantly against rivals, potentially reaching 25%+ share—a commanding position no other brand comes close to matching.

Apple’s Remarkable Surge: Apple’s 47% annual growth to 4.9 million units (10% share) represents the most impressive performance among top brands. Strategic pricing for older models, expanded retail presence, and premiumization trends drove this explosive expansion in India’s aspirational segment.

Samsung & Xiaomi Struggle: Both giants faced headwinds—Samsung dropped 9% to 6.8 million units (14% share), while Xiaomi plunged 17% to 6.5 million shipments (13% share). Intense mid-range competition and shifting consumer preferences toward premium devices impacted their traditional strongholds.

Emerging Winners

Beyond the top 5, Motorola surged 53% year-over-year, while Nothing recorded a staggering 66% growth, showcasing how innovative brands can disrupt India’s crowded market with differentiated offerings and aggressive pricing strategies.

Market Insights

The 3% overall growth to 48.4 million units in Q3 2025 signals stabilization after pandemic-era volatility. Premiumization continues driving value growth despite modest volume increases. For comprehensive tech analysis, visit TechnoSports.

The Verdict: Vivo’s ecosystem strategy, Apple’s premium push, and emerging brands’ disruptive growth define India’s evolving smartphone landscape heading into 2026.

FAQs

Which smartphone brand leads India in Q3 2025?

Vivo dominates with 20% market share (9.7 million units), excluding its iQOO sub-brand.

Why did Apple grow 47% in India?

Strategic pricing for older iPhones, expanded retail presence, and growing premium segment demand fueled Apple’s impressive growth.