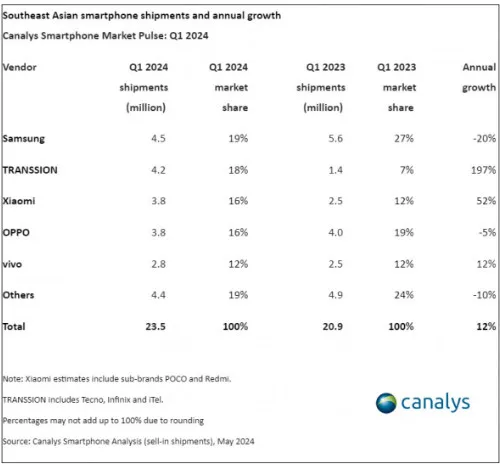

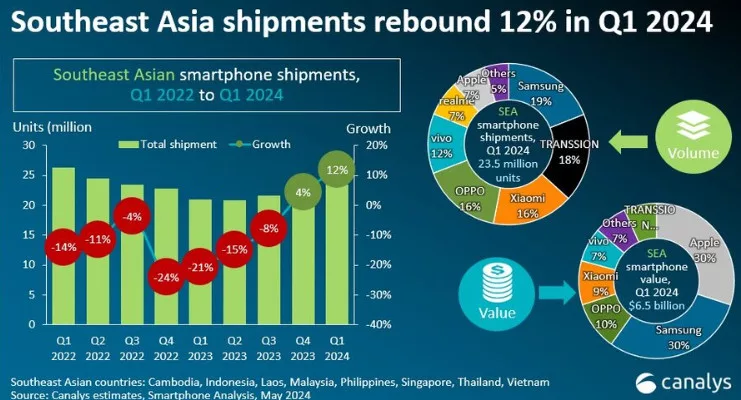

The Southeast Asian smartphone market was given a further boost after a challenging 2020 when the region recorded an impressive 12% year-on-year growth in Q1 this year as per Canalys’ latest report. Smartphone shipments, though up 181 percent year-over-year (YoY), remained below pre-2023 levels at 23.5 million units.

All About the Canalys Report

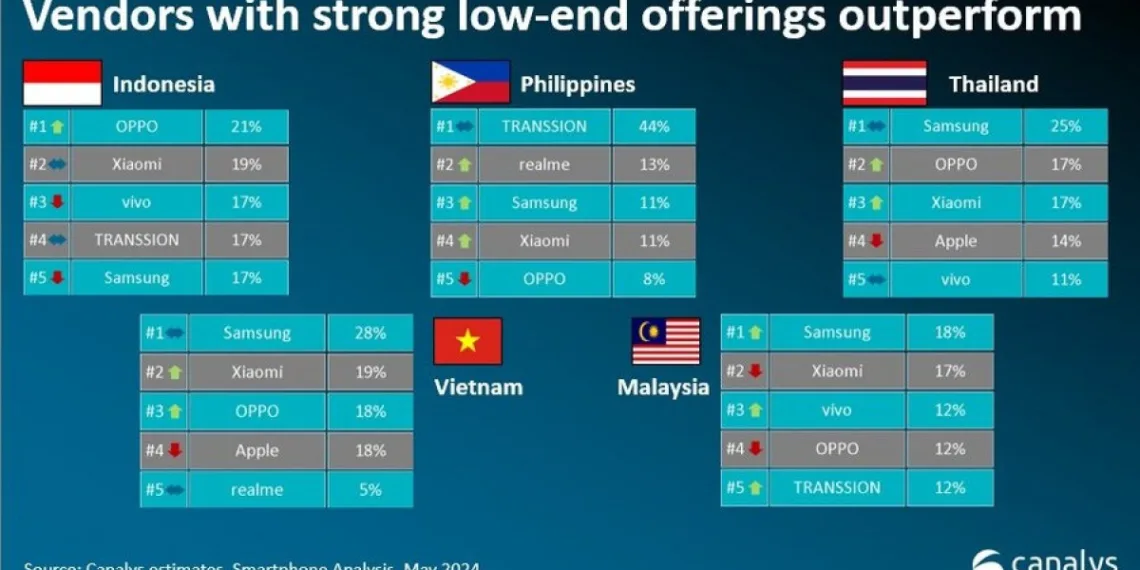

Q1’s success can also be related to a number of different factors with markets such as Indonesia and Malaysia seeing increased demand due in part, to Ramadan. In addition, companies like Transsion took advantage of the revival in the sub-$100 segment to gain a share, particularly in markets such as the Philippines and Indonesia.

Even though it is lying flat after a 20% year-over-year shipment number, Samsung will keep its 19% share of the market. The decline is seen as part of Samsung’s strategic refocusing to concentrate more on the mid-tier and high-end, in hopes that consumer trends will move back toward higher specification smartphones soon.

In second position is Transsion (Infinix, Tecno & itel) with 18% market share seeing an impressive growth of 197%, YoY. For Transsion, which has leaped over rivals such as Oppo and Xiaomi in the region, its development is a tale of how effectively it has been able to address the Southeast Asian market

Even though Xiaomi posted an impressive 52 percent year-over-year increase in sales from the quarter, it couldn’t catch Transsion. The Oppo registers a 12 percent drop compared to the last year However, analysts cautioned that future uncertainties such as fluctuating currencies, and increases in the price of components among others could lead to change directions on market expansion. Companies that have the most efficient supply chains and inventories will survive the biggest storm.

To sum up Canalys’ report, the research outfit says the Southeast Asian smartphone market is off to a good start in 2024 thanks to Ramadan and recurring sub-$100 demand. In our view, as a result of these rapid rises from Transsion and to some extent their stable peers there are still rapidly changing dynamics across the markets where Samsung has long been able to perpetuate its lead.

Nonetheless, the market’s overarching evolution is still impacted by externalities. For players in India’s smartphone industry, this means being adaptable and remaining robustly responsive.