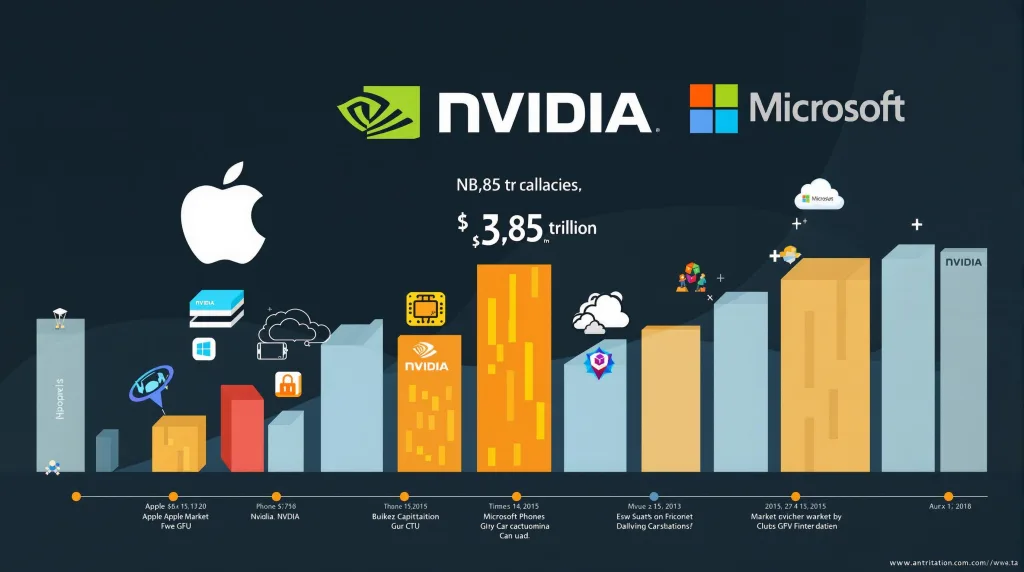

Apple Inc., the world’s most valuable company, is on the brink of achieving a historic milestone: a $4 trillion market valuation. With its stock surging by approximately 16% since early November 2024, Apple has pulled ahead of tech giants Nvidia and Microsoft, solidifying its dominance in the global tech industry. The company’s market capitalization now stands at an impressive $3.85 trillion, with a staggering $500 billion added in just a few weeks.

Table of Contents

What’s Driving Apple’s Meteoric Rise?

Apple’s recent surge in valuation is fueled by a combination of factors that have reignited investor confidence and enthusiasm for the company’s future:

1. Advancements in Artificial Intelligence (AI):

Apple’s growing focus on AI-driven innovations has captured the attention of investors. While companies like Nvidia have been at the forefront of AI hardware, Apple is leveraging its ecosystem to integrate AI into its products and services seamlessly. From AI-powered features in iOS to advancements in machine learning for its devices, Apple’s strategic approach to AI is seen as a key growth driver.

2. Anticipation of a New iPhone Upgrade Cycle:

The tech giant is also benefiting from heightened expectations surrounding its next iPhone upgrade cycle. With rumors of groundbreaking features and hardware improvements, Apple is poised to attract a wave of upgrades from its loyal customer base. This anticipation has further boosted investor sentiment, contributing to the recent rally in its stock price.

3. Resilience Amid Market Volatility:

While other tech companies have faced challenges due to market volatility, Apple’s diversified revenue streams and strong brand loyalty have helped it maintain stability. Its ability to consistently deliver high-margin products and services has made it a safe bet for investors, even in uncertain times.

Apple vs. Nvidia and Microsoft: The Race to $4 Trillion

Apple’s rise to a $3.85 trillion valuation has put it ahead of Nvidia and Microsoft in the race to the $4 trillion milestone. Here’s how the competition stacks up:

- Nvidia: Known for its dominance in AI and GPU technology, Nvidia has seen significant growth in recent years. However, its market cap currently trails behind Apple’s, as the latter’s diversified portfolio and ecosystem give it a broader appeal.

- Microsoft: Despite its strong position in cloud computing and enterprise software, Microsoft has been unable to match Apple’s recent momentum. Apple’s consumer-focused innovations and ecosystem integration have given it an edge in capturing market value.

Apple’s ability to outpace these tech giants highlights its unique position in the industry, where it combines cutting-edge technology with a loyal customer base and a robust ecosystem.

The $500 Billion Surge: A Closer Look

Since early November 2024, Apple has added an astonishing $500 billion to its market capitalization. To put this into perspective, this increase alone is larger than the entire market cap of many Fortune 500 companies. The surge reflects not only investor confidence but also Apple’s ability to consistently deliver value to its shareholders.

This growth has been driven by a 16% jump in Apple’s share price, which has outperformed many of its peers in the tech sector. The company’s strong fundamentals, combined with its forward-looking approach to innovation, have made it a standout performer in the stock market.

What’s Next for Apple?

As Apple inches closer to the $4 trillion milestone, the question on everyone’s mind is: what’s next for the tech giant? Here are some key areas to watch:

1. AI Integration Across the Ecosystem:

Apple’s continued investment in AI is expected to play a pivotal role in its future growth. From Siri enhancements to AI-powered health features on the Apple Watch, the company is likely to expand its AI capabilities across its product lineup.

2. New Product Launches:

Apple’s rumored mixed-reality headset and advancements in autonomous vehicle technology could open up new revenue streams and further solidify its position as a leader in innovation.

3. Services Growth:

Apple’s services segment, which includes Apple Music, iCloud, and Apple TV+, has been a major contributor to its revenue. Continued growth in this area will be critical as the company looks to diversify beyond hardware sales.

Why Apple’s $4 Trillion Milestone Matters

Reaching a $4 trillion valuation would not only be a historic achievement for Apple but also a testament to its enduring relevance and dominance in the tech industry. It would solidify Apple’s position as a trailblazer, setting a benchmark for other companies to aspire to.

For investors, this milestone represents Apple’s ability to adapt, innovate, and thrive in an ever-changing market. It also underscores the company’s resilience and its ability to consistently deliver value, even in challenging economic conditions.

Final Thoughts: Apple’s Unstoppable Momentum

Apple’s journey to a $4 trillion valuation is a reflection of its unparalleled ability to innovate and capture the imagination of consumers and investors alike. With advancements in AI, a highly anticipated iPhone upgrade cycle, and a robust ecosystem of products and services, Apple is well-positioned to continue its upward trajectory.

As the company inches closer to this monumental milestone, all eyes will be on its next moves. Whether it’s new product launches, AI breakthroughs, or continued growth in services, one thing is clear: Apple’s best days are still ahead.