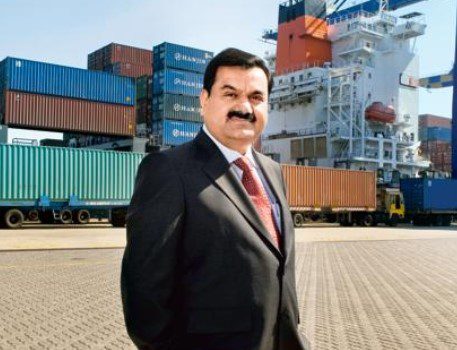

The Indian billionaire, who was once Asia’s richest person, has recruited top US crisis communication and legal teams, abandoned plans to buy an $850 million coal plant, cut costs, paid back some debt, and planned to return more. From third to thirty-first in terms of wealth, Gautam drops.

Since Hindenburg Research published a report on January 24 accusing Adani Group of accounting fraud, stock manipulation, and other breaches of corporate governance, the company is attempting to win back and reassure the nervous lenders and investors. Every one of these accusations is still refuted by The Adani Group.

Everything you need to know about Adani’s action

In the wake of the Hindenburg report, the market has been in a tailspin, and Adani Group has been prepaying a couple of its loans to try to win back investor trust. Reuters reported today that Adani Ports and Special Economic Zone planned to prepay ₹1,000 crores in commercial papers due in March 2023. A company representative confirmed this. For commercial papers that matured on Monday, Adani Ports also paid ₹1,500 crores to SBI Mutual Fund as part of its recovery plan.

Adani Ports had earlier this month stated that it was thinking about paying back the loan of roughly ₹5,000 crores in the fiscal year 2023–24 before making this declaration. Plans for a capex of 10,000 crores have been reviewed by Adani Greens. They stated in their Q3 earnings that their plans for capital expenditures totaling 10,000 crores have been reviewed.

In an effort to calm investors’ fears, Gautam Adani and his family paid off debt secured by shares totaling ₹9,250 crore earlier this month. The Adani Group has stated that “this is in continuation of promoters’ pledge to prepay all share-backed finance.” Now that Hindenburg Research has released its report against Adani Group, it remains to be seen how long the stock crash lasts amidst Adani Group’s actions to recover. One month has nearly passed since that time.