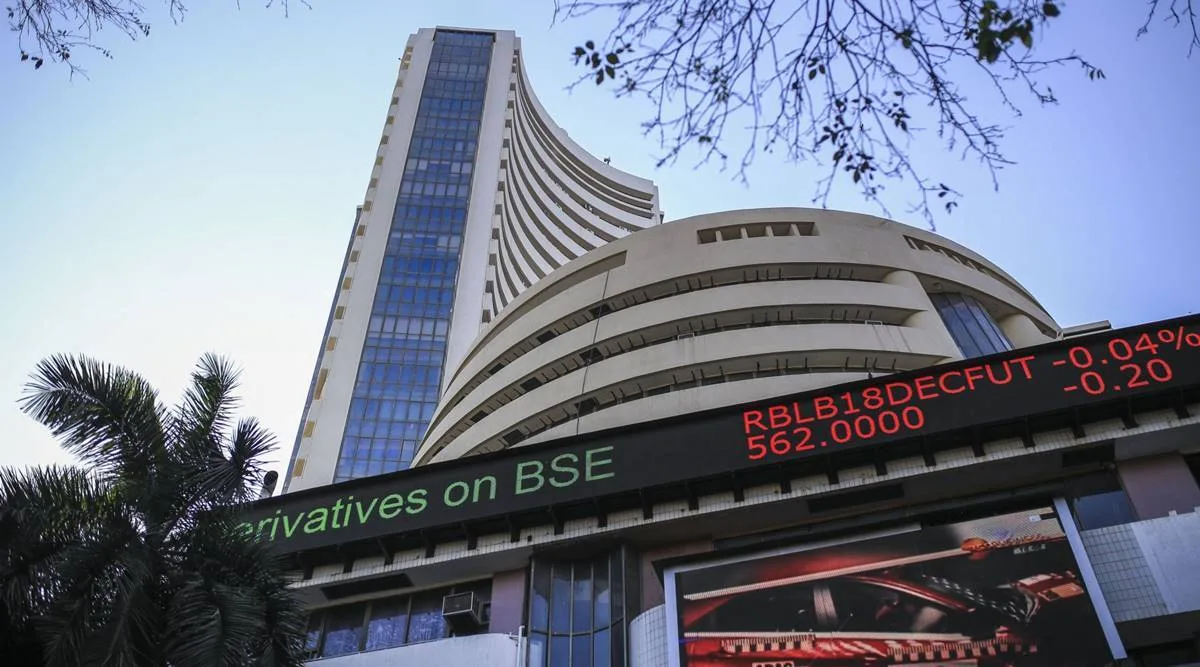

Sensex Crash Today: In a shocking turn of events, the Indian stock market experienced a severe downturn on April 7, 2025, sending ripples through the global financial community. The BSE Sensex, India’s benchmark stock index, plummeted by an unprecedented 3,939 points, closing at 71,425.01 in early trade. This dramatic fall has left investors reeling and analysts scrambling to make sense of the sudden market volatility.

Table of Contents

The Crash: By the Numbers

The Indian stock market crash has sent shockwaves through the financial world, with the Sensex witnessing its steepest single-day decline since the 2020 pandemic-induced crash. Here’s a breakdown of the carnage:

- BSE Sensex: Fell by 3,939 points (5.23%) to 71,425.01

- Nifty 50: Tumbled 1,160 points (5.07%) to 21,743

- Market capitalization: Over ₹16 lakh crore wiped out in a single day

Investors are scrambling to understand the implications of the recent Sensex crash, with many drawing parallels to previous market meltdowns. The BSE Sensex saw its biggest single-day fall in recent history, surpassing even the volatility experienced during the global financial crisis of 2008.

Global Factors: Trump’s Tariffs and Beyond

The impact of Trump tariffs on Sensex has been more severe than initially anticipated. The announcement of sweeping tariffs by former U.S. President Donald Trump, now back in office, has sent global markets into a tailspin. These tariffs, ranging from 10% to 49% on various imports, have raised fears of a full-blown trade war and a potential global recession.

Key factors contributing to the stock market meltdown include:

- U.S. tariffs on imports, particularly affecting IT and automotive sectors

- Fears of retaliatory measures from other major economies

- Concerns over global economic slowdown

- Uncertainty in domestic political landscape ahead of Indian general elections

The combination of these factors has created a perfect storm, leading to what analysts are terming a significant stock market meltdown.

Sector-Specific Impacts

The Sensex crash has not affected all sectors equally. Here’s a sector-wise breakdown of the impact:

- Information Technology (IT): Major IT companies like TCS, Infosys, and Wipro saw their stock prices plummet by 8-10% due to fears of reduced U.S. corporate spending.

- Automobiles: The auto sector, already grappling with supply chain issues, faced further pressure with stocks of Maruti Suzuki and Tata Motors falling by 6-7%.

- Banking and Financial Services: Despite being considered a relatively safe haven, banking stocks like HDFC Bank and ICICI Bank also saw declines of 4-5%.

- Pharmaceuticals: Interestingly, pharma stocks showed resilience, with some even gaining ground as investors sought refuge in defensive sectors.

- Metals and Mining: This sector faced significant pressure, with stocks of major players like Tata Steel and Hindalco falling by 7-8%.

The varied impact across sectors highlights the complex nature of this market crash and the need for a nuanced understanding of its implications.4

Historical Context: Past Crashes and Recoveries

To put the current Sensex crash in perspective, it’s worth looking at previous significant market downturns:

- 2008 Global Financial Crisis: The Sensex fell from around 21,000 points to 8,000 points, a decline of over 60%. However, it rebounded to 20,000 points by 2010.

- 2020 COVID-19 Crash: The index dropped from 42,000 to 26,000 points (38% decline) but recovered swiftly, reaching new highs by early 2021.

These historical examples suggest that while market crashes can be severe, recovery often follows, albeit with varying timeframes.

Conclusion: Key Takeaways for Investors

As the dust settles on this tumultuous day in the Indian stock market, here are some key points for investors to consider:

- Stay calm and avoid panic selling. Historical trends show markets often recover over time.

- Focus on quality stocks with strong fundamentals.

- Consider diversifying portfolios to spread risk.

- Keep an eye on global developments, particularly regarding trade policies.

- Consult with financial advisors to make informed decisions based on individual risk tolerance and investment goals.

The Sensex crash of today serves as a stark reminder of the interconnectedness of global markets and the impact of geopolitical events on financial systems. While the road ahead may be bumpy, understanding the factors at play and maintaining a long-term perspective can help investors navigate these turbulent times.