Adani Ports & SEZ has 100% “Buy” ratings, which means that all analysts that follow this Adani group company have recommended buying it. Even though a few rating agencies have changed their stance on the company’s instruments to negative, this is still the case.

According to Motilal Oswal Securities, Adani Ports has a ‘Buy’ rating from a total of 21 analysts, with a consensus price objective of ₹803. On Monday’s trading, the stock was trading at ₹697.85 and had increased 26% in the previous month.

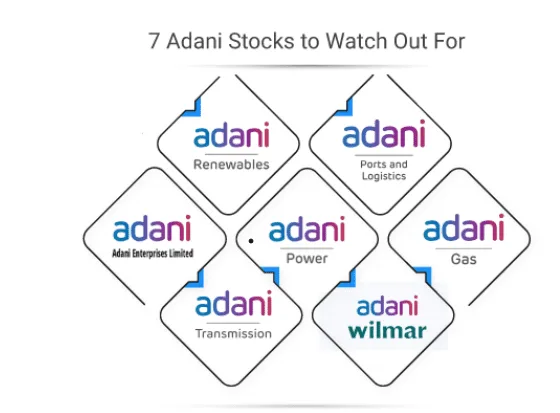

Everything you need to know about Adani Stocks!

JM Financial recently began coverage of Adani Ports & SEZ with a “Buy” rating and a target price of ₹800, as domestic brokerage expects Adani Ports to maintain its market-leading position in India with volume growth of 16%, translating into revenue growth of 15%, Ebitda growth of 15%, and PAT growth of 13%, compounded annually over FY23–25E. According to JM Financial, Adani Ports Ltd. may generate a total OCF of ₹26,100 crore in FY24–25 and incur capex of ₹12,000 crores, yielding ₹14,000 crores in free cash flow, which is significantly greater than its debt-repayment obligations of ₹11,000 crore.

Adani Ports was one of ICICIdirect’s recommended stocks for March. According to the statement, Adani Ports is supported by robust FCF-generating assets with a RoCE of 15% or higher. It also has a healthy debt-to-equity ratio that is close to 1. The target price set by this brokerage for the stock is ₹800. The stock is priced at ₹810 by Kotak Institutional Equities. According to the company’s guidance for the financial year 2024, it should experience solid low- to high-teens organic growth and deleverage to 2.5x net debt to Ebitda, according to a February note from Kotak.

Recently, the ratings were confirmed by the rating agency ICRA, which also changed the outlook for the group company from “stable” to “negative”. ICRA stated on March 3 that one of the ports’ main credit strengths that have been negatively damaged is its history of refinancing a sizable portion of its debt with longer-term loans at cheaper interest rates.

Additionally, according to ICRA, the group entities are at a higher risk of being subject to legal and regulatory scrutiny, and their effects on Adani Ports’ credit rating would be watched carefully. ICRA gave this as its justification for downgrading the ports, noting that the company’s financial profile is still strong and that a sizable $650 million international bond repayment is not due until the financial year 2025.