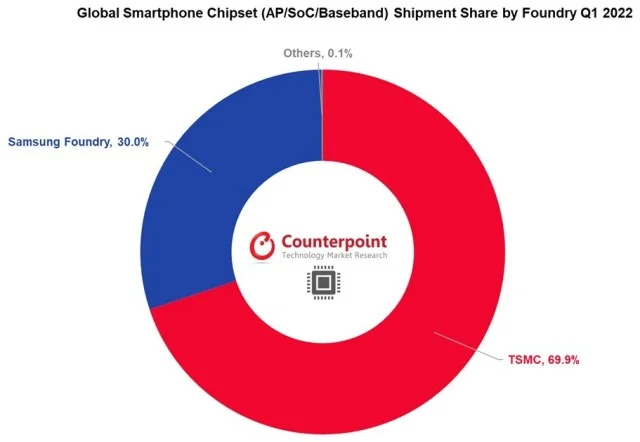

Taiwan Semiconductor Manufacturing Company (TSMC) continues its unstoppable rise, capturing 70.2% market share in Q2 2025 – up from 67.6% the previous quarter. The semiconductor giant’s revenue soared to $30.239 billion, cementing its position as the world’s leading chip foundry.

Table of Contents

TSMC’s Record-Breaking Financial Performance

The company achieved remarkable 18.5% quarterly revenue growth, driven by surging demand for AI chips, smartphones, PCs, and server components. Industry-wide revenue grew an impressive 14.6% compared to Q1 2025, fueled by national subsidies and aggressive product stocking.

Market Share Comparison Q2 2025

| Company | Market Share | Revenue | Quarterly Growth |

|---|---|---|---|

| TSMC | 70.2% | $30.239B | +18.5% |

| Samsung | 7.3% | $3.159B | +9.2% |

| Others | 22.5% | – | – |

Samsung Faces Mounting Pressure

While TSMC dominates, Samsung’s foundry business struggles with market share dropping from 7.7% to 7.3%. Despite generating $3.159 billion in revenue, Samsung remains a distant second to TSMC’s semiconductor empire.

However, Samsung isn’t giving up. The Korean giant is developing its 2nm GAA (Gate-All-Around) process and plans to launch the Exynos 2600 chipset before TSMC’s competing technology.

Future Growth Projections

TSMC’s dominance shows no signs of slowing. According to TrendForce research, the company’s market share could reach 75% by 2026. Key growth drivers include:

- 2nm chip production starting Q4 2025

- Major orders from Apple, Qualcomm, MediaTek, and Broadcom

- $49 billion investment in new 1.4nm manufacturing facility

Apple has already secured nearly half of TSMC’s initial 2nm wafer supply, ensuring priority access to cutting-edge semiconductor technology.

Technology Leadership Strategy

TSMC’s success stems from consistent innovation and massive capital investments. The company’s upcoming 1.4nm facility represents the next frontier in semiconductor miniaturization, maintaining technological superiority over competitors.

For more insights on semiconductor industry trends, explore TechnoSports’ technology coverage and stay updated with chip manufacturing developments.

The foundry wars continue intensifying as demand for advanced processors grows across AI, mobile, and computing sectors.

FAQs

What drove TSMC’s market share growth to 70% in Q2 2025?

Strong demand for AI chips, smartphones, and server components, plus 18.5% quarterly revenue growth.

When will TSMC start mass producing 2nm chips?

TSMC begins 2nm mass production in Q4 2025, with Apple securing nearly half the initial supply.