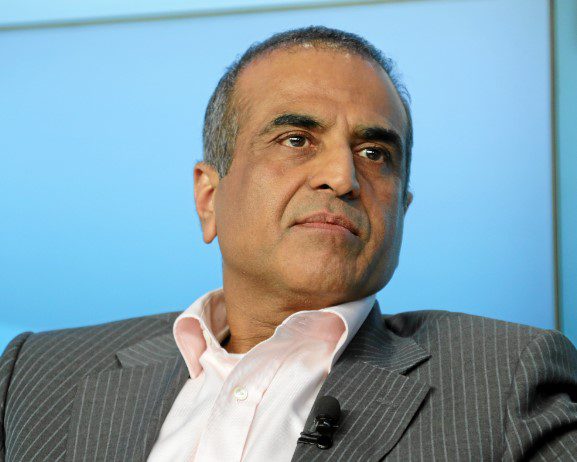

According to those with knowledge of the situation, Indian telecom mogul Sunil Mittal wants to acquire a stake in Paytm by combining his financial services business with the payments bank of the fintech behemoth.

Sunil Mittal wants to invest in Paytm after Alibaba exits

According to the individuals, who declined to be identified because they were disclosing sensitive information, Mittal intends to combine Airtel Payments Bank and Paytm Payments Bank through a stock transaction and also purchase additional Paytm equity from other shareholders. Airtel and Paytm may not achieve an agreement at this point in the negotiations, the people said.

Shares of Paytm, formerly One 97 Communications Ltd., have increased by roughly 40% since hitting a record low in November as the company appears to be beginning to earn a profit. As a result of efforts to increase its client base, the company’s third-quarter deficit was reduced, it reported in a filing with the exchange this month. A Paytm official issued the following comment via email: “We remain fully focused on our strong organic development trajectory and are not involved in any such discussions.” A spokesperson for Mittal-owned Bharti Enterprises Ltd. said the business won’t respond to speculative market reports.

Paytm, once the most valued company in India, had the worst first-year share decline among major IPOs over the previous ten years and has never traded above its IPO price of 2,150 rupees since being listed in November 2021. China’s Ant Group Co. and Japan’s SoftBank Group Corp. are among the investors in the business. In the year ending March 31, 2022, Mittal’s six-year-old payments bank, which had 129 million clients, achieved profitability, according to exchange records.

To draw in more clients and persuade investors of its profitability potential, Paytm is expanding the range of products it offers. One 97 Communications is the subject of buy or overweight recommendations from eight brokerages, according to data gathered by Bloomberg, with a consensus one-year price objective of 944.64 rupees.