SBI Saral Banking is State Bank of India’s simplified corporate internet banking solution designed specifically for small entrepreneurs, sole proprietors, and micro enterprises. This comprehensive guide in 2025 covers everything you need to know about SBI Saral Banking’s features, benefits, registration process, and how it can transform your business banking experience.

Table of Contents

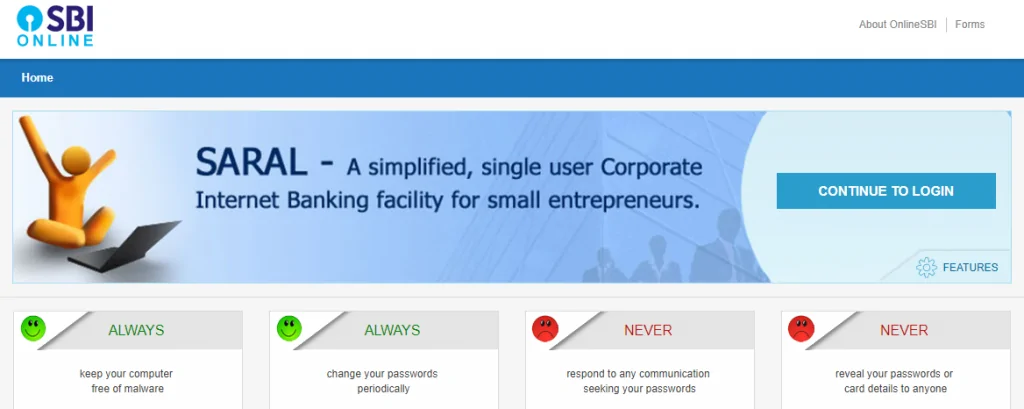

What is SBI Saral Banking in 2025?

SBI Saral Banking is a simplified single-user transactional product ideally suited for sole proprietorship concerns, microenterprises, and individual businessmen who require online transaction facilities in their business accounts. It’s a simplified version of corporate Internet Banking with default transaction rights.

The facility is highly customer-friendly and provides the ease and convenience of Retail Internet Banking without compromising on the security of the customer.

Key Features

Transaction Capabilities

SBI Saral Banking is single-user operated, user-friendly, and simple, providing transaction rights on accounts with the facility to view account information and download account statements.

The platform offers comprehensive transaction facilities including:

- Fund Transfers: Transfer to own accounts in the same branch of SBI/own accounts in different branches of SBI up to ₹2 crore per day

- Inter-bank Transfers: Up to ₹5 lakh inter-bank fund transfers per day to another bank’s account

- Third-party Transfers: Fund transfer to accounts other than own account in SBI/Fund Transfer to accounts in other Banks with consolidated limit of ₹10 lacs per day

Payment Services

SBI Saral Banking enables payment of state government taxes and both direct taxes like CBDT and indirect taxes like Customs. Users can also request DD issue of a maximum of Rs.5 lakh per day, along with bill payments, EPF subscription payment, and merchant services.

Advanced Features

SBI Online Saral allows small entrepreneurs to avail SBI online payment up to Rs 5 lakh per day. It also provides the facility to schedule transactions for a later date and set beneficiary level limits.

Benefits

1. Simplified Operations

- Single-user interface designed for ease of use

- No complex multi-user authorization requirements

- Streamlined navigation suitable for small business owners

2. Cost-Effective Solution

- Lower fees compared to full corporate banking packages

- No need for expensive enterprise-level banking solutions

- Reduced operational costs for small businesses

3. 24/7 Accessibility

- Access your business accounts anytime, anywhere

- No dependency on banking hours

- Real-time transaction processing

4. Enhanced Security

- Bank-grade security protocols

- Secure login procedures

- Transaction limits to prevent unauthorized access

5. Comprehensive Banking Services

- Account management

- Statement downloads

- Tax payments

- Bill payments

- Fund transfers

Who Can Use SBI Saral Banking?

SBI Saral Banking is specifically designed for:

- Sole Proprietors: Individual business owners operating under their own name

- Micro Enterprises: Small businesses with limited transaction volumes

- Individual Businessmen: Entrepreneurs requiring basic corporate banking facilities

- Small Entrepreneurs: Business owners seeking simplified banking solutions

Registration Process

Step 1: Eligibility Check

Ensure you have:

- A current account with State Bank of India

- Valid business registration documents

- KYC compliance completed

Step 2: Application Submission

- Visit your nearest SBI branch

- Submit the SBI Saral Banking application form

- Provide required documents and identification

Step 3: Documentation

Required documents typically include:

- Account opening documents

- Business registration proof

- Identity and address verification

- Authorized signatory details

Step 4: Activation

- Receive login credentials from the bank

- Complete initial setup and security configuration

- Start using SBI Saral Banking services

Transaction Limits in SBI Saral Banking

| Transaction Type | Daily Limit |

|---|---|

| Own Account Transfers (Same Branch) | ₹2 Crore |

| Own Account Transfers (Different Branch) | ₹2 Crore |

| Inter-bank Transfers | ₹5 Lakh |

| Third-party SBI Transfers | ₹10 Lakh |

| DD Requests | ₹5 Lakh |

| Tax Payments | As per requirement |

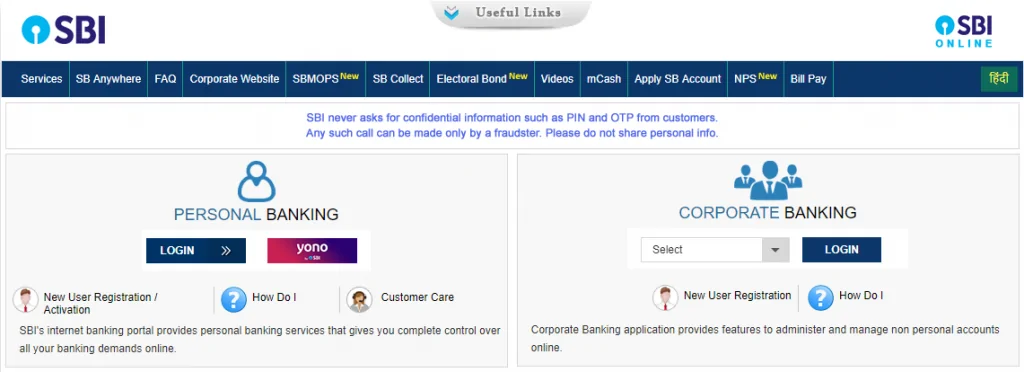

How to Access?

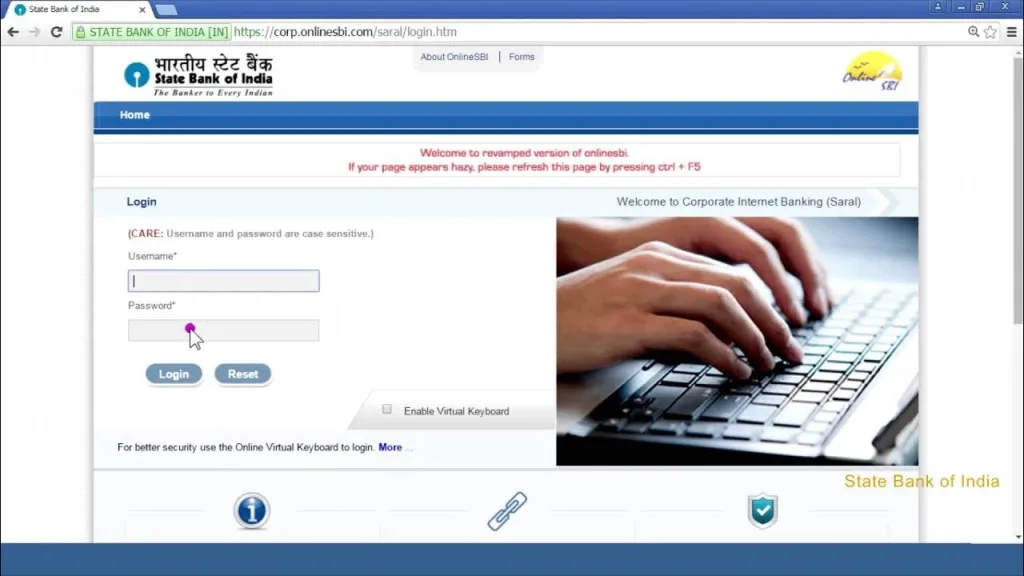

Online Access

- Visit the official SBI Corporate Banking portal

- Select “Saral” from the login options

- Enter your user ID and password

- Complete security authentication

- Access your dashboard

Mobile Access

While primarily web-based, it can be accessed through mobile browsers with responsive design compatibility.

SBI Saral Banking vs Other SBI Corporate Products

| Feature | SBI Saral | SBI Vyapaar | SBI Vistaar |

|---|---|---|---|

| User Type | Single User | Multiple Users | Enterprise |

| Complexity | Simple | Moderate | Complex |

| Target Audience | Micro Enterprises | SMEs | Large Corporations |

| Transaction Limits | Moderate | Higher | Highest |

| Cost | Lower | Moderate | Higher |

Tips for Effective SBI Saral Banking Usage in 2025

1. Regular Monitoring

- Check account statements regularly

- Monitor transaction limits

- Review beneficiary lists periodically

2. Security Best Practices

- Use strong passwords

- Log out after each session

- Don’t share login credentials

- Enable transaction alerts

3. Optimize Transaction Scheduling

- Use scheduling features for recurring payments

- Set up beneficiary limits appropriately

- Plan high-value transfers within daily limits

Common Issues and Solutions

Login Problems

- Clear browser cache and cookies

- Check internet connectivity

- Verify login credentials

- Contact customer support if persistent

Transaction Failures

- Verify beneficiary details

- Check available balance

- Ensure compliance with transaction limits

- Retry after some time

Statement Issues

- Check date range selection

- Verify account selection

- Try downloading in different formats

- Contact branch for assistance

Future of SBI Saral Banking

With the evolution of digital banking, SBI continues to enhance Saral Banking with:

- Improved user interface

- Additional payment gateways

- Enhanced security features

- Better mobile compatibility

- Integration with government portals

Conclusion

SBI Saral Banking represents an ideal solution for small businesses and entrepreneurs seeking simplified corporate banking services. With its user-friendly interface, comprehensive features, and cost-effective approach, it bridges the gap between personal and complex corporate banking solutions.

Whether you’re a sole proprietor, micro-enterprise owner, or individual businessman, SBI Saral Banking provides the tools and flexibility needed to manage your business finances efficiently. The platform’s emphasis on simplicity without compromising security makes it an excellent choice for growing businesses.

Frequently Asked Questions (FAQs)

Q: What is the minimum balance requirement for SBI Saral Banking?

A: The minimum balance requirement depends on your account type and branch location. Contact your SBI branch for specific details.

Q: Can I add multiple users to SBI Saral Banking?

A: No, it is designed as a single-user platform. For multiple users, consider SBI Vyapaar or Vistaar.

Q: Are there any charges for using SBI Saral Banking?

A: Yes, standard corporate banking charges apply. Check with your branch for the current fee structure.

Q: Can I transfer money to international accounts through SBI Saral Banking?

A: It primarily focuses on domestic transactions. For international transfers, contact your branch for available options.

Q: How secure is SBI Saral Banking?

A: It uses bank-grade security protocols, including encrypted connections and secure authentication methods.

For the latest updates on features and services, visit the official State Bank of India website or contact your nearest SBI branch.