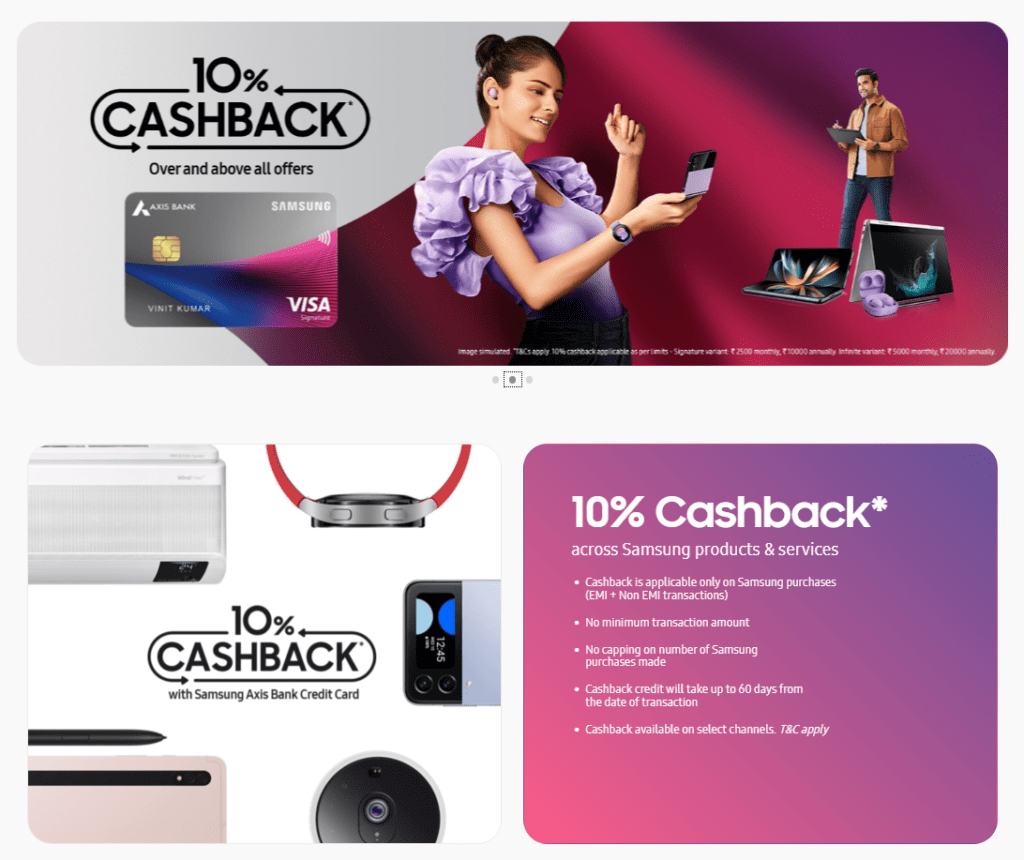

South Korean electronics giant Samsung has introduced a new strategy to up its sales during this year’s festive season – a co-branded credit card. The company has joined hands with Mumbai-based Axis Bank and payments processor Visa for the card it is calling ‘Samsung Axis Bank Credit Card.’ The company has announced a cashback of 10% on Samsung products and services on transactions done using its credit cards.

Samsung Axis Bank Credit Card

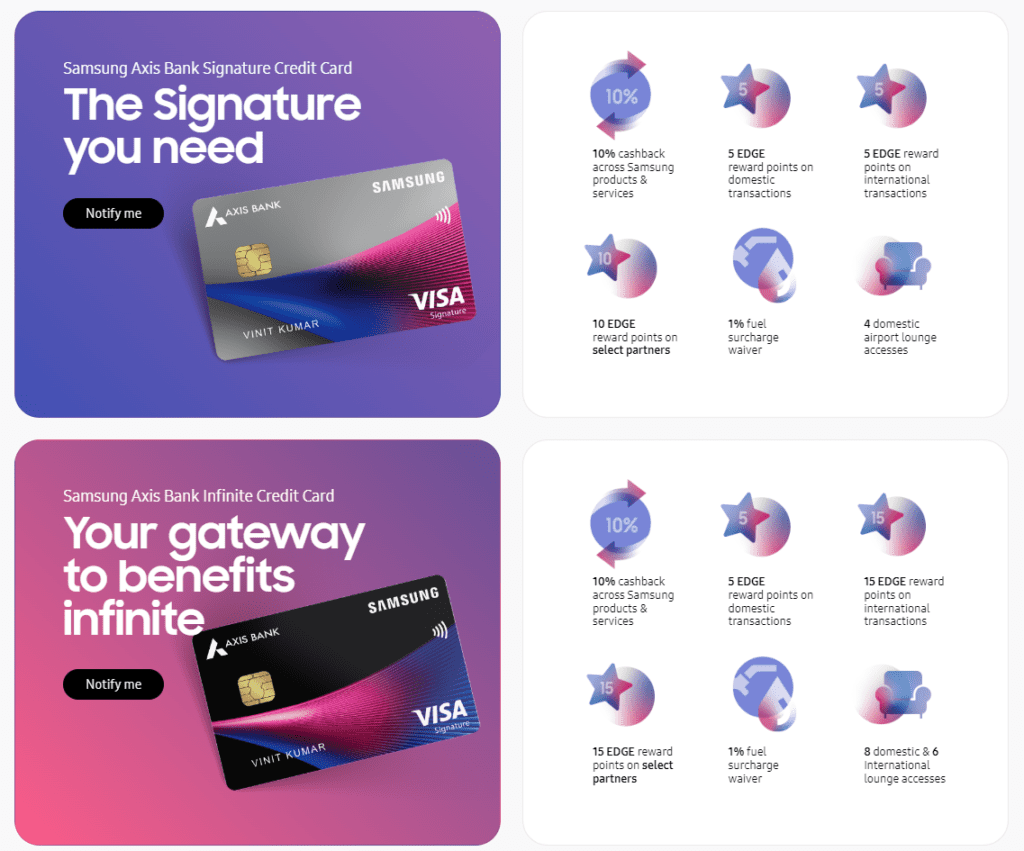

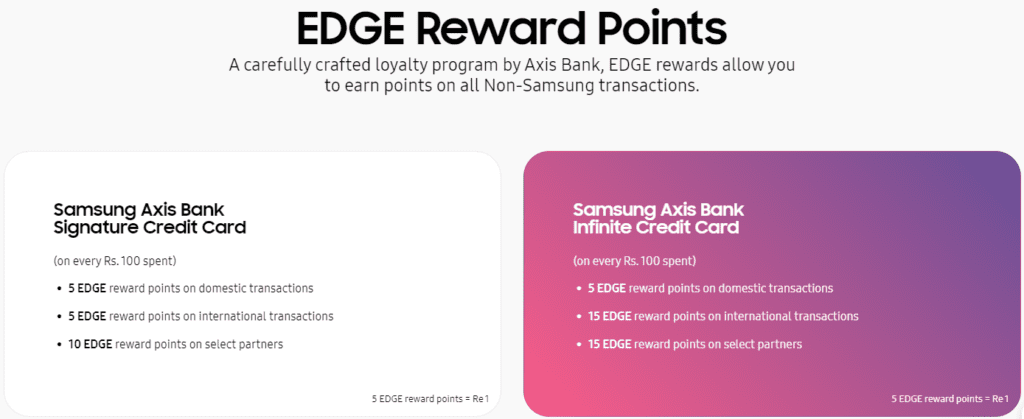

A credit card was introduced by Samsung India and Axis Bank. In addition to additional benefits like access to airport lounges, reward points for the banking institution, and a 1% fuel fee waiver, the corporation is giving 10% cashback on purchases.

India’s credit card space is much behind debit cards. According to estimates, there are less than 25 million credit card users in the country. With the introduction of its own credit cards, Samsung gets a chance to tap into the uncharted potential of this market.

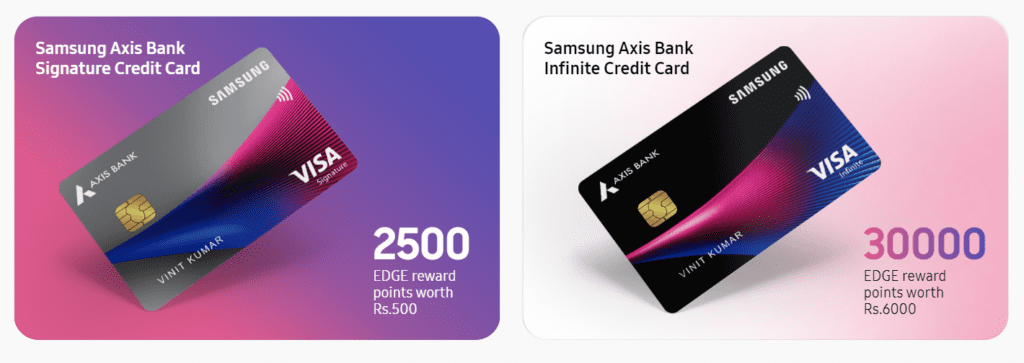

Samsung has launched two kinds of credit cards – Visa Signature and Visa Infinite. On the former, there is Rs. 2,500 monthly cashback limit, while on the latter, the limit is Rs. 5,000. Annually, the cashback limits are set at Rs. 10,000 and Rs. 20,000, respectively. The annual fee on the cards is Rs. 500 (plus taxes) and Rs. 5,000 (plus taxes), respectively.

Ken Kang, president and CEO, Samsung South-West Asia, says the Samsung Axis Bank Credit Card, powered by Visa, is the company’s next big India-specific innovation. “(It) will change the way our customers buy Samsung products and spend on services through a series of industry-leading features.”

The CEO of Axis Bank revealed that the new product aims to go beyond the top 10 cities and Penetrates tier 2 and tier 3 cities. A Visa executive revealed that three-quarters of Indians have purchased at least one electronic product and spent around Indian rupees 40, once a year.

As of July 2022, Axis Bank has the fourth largest market share in credit card spending of 8.7%, after HDFC Bank, ICICI Bank and SBI Card, which have 28.34%, 20.1% and 16.7% market shares, respectively. With this launch, Axis Bank is aiming to penetrate into tier 2 and tier 3 cities. Amitabh Chaudhary, MD and CEO, Axis Bank said the bank aims to tap the wide reach of Samsung India that extends beyond tier 1 cities and aids its objective of card penetration into tier 2 & 3 cities.

Samsung, the second largest smartphone vendor in India, said it will also offer customers “exciting” financing options on credit cards. The cards are especially aimed at serving consumers in smaller Indian cities and towns, the executives said.