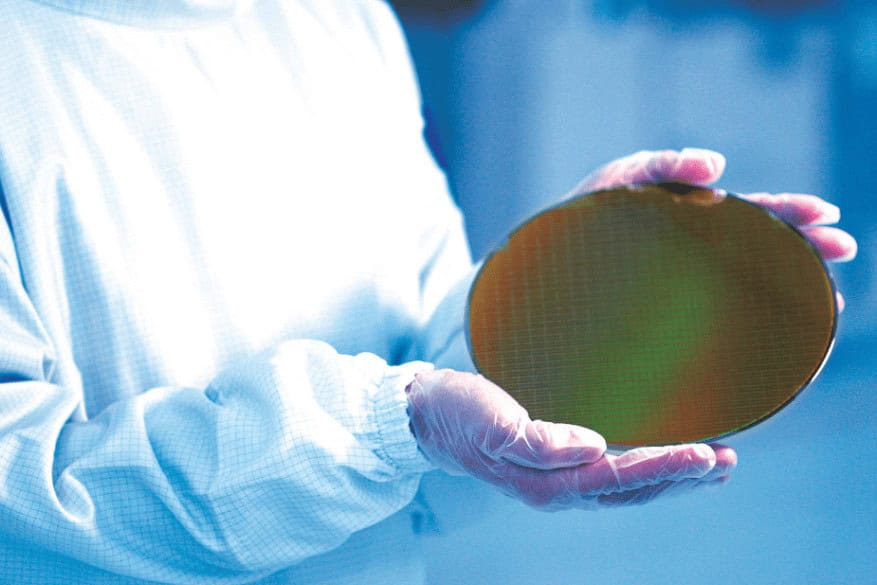

In a Hong Kong investor forum, Samsung disclosed its firm commitment to becoming a formidable player in the semiconductor industry through its foundry division. Despite the company’s historical focus on its mobile division, officials have indicated plans to diversify the sales structure by expanding the customer base in areas such as semiconductor applications for AI and automobiles.

More About Samsung Foundry Contracts

Key players, including hyper scalers (large-scale data center operators), automobile OEMs (original equipment manufacturers), and Tesla, have approached Samsung for customized chip designs. When asked about the preference for Samsung, the response highlighted the company’s comprehensive capabilities in all three areas—foundries, memory, and semiconductors.

Samsung’s President Jeong Hai-Lin expressed the company’s mission to bring imagination to life in the semiconductor realm, encompassing foundries, memory, and other innovations. Some customers are reportedly planning to market the 4-nanometer AI accelerator developed by Samsung. Notably, a leading electric vehicle company, at the forefront of the automotive industry, is moving towards the 5-nanometer technology, with Samsung actively involved in developing a fully autonomous chiplet.

The statement indicates a notable interest in Samsung’s 4nm process, particularly in the AI segment. Reports suggest that Samsung has successfully passed critical quality tests for its next-gen HBM3 memory, positioning itself as a potential partner for AMD. While it remains uncertain whether Samsung will collaborate on the development of MI300 accelerators, it is suggested that certain IPs may be produced by Samsung, with the overall chip design leaning towards TSMC. Samsung is also establishing its advanced chip manufacturing ecosystem, “SAINT,” to compete with TSMC’s CoWoS.

Apart from AI orders, Samsung has secured contracts from Tesla, with a focus on a “5-nanometer” process. This suggests potential use in Tesla’s next-generation HW 5.0 chips, designed for Full-Self Driving applications. As of this year, Samsung Electronics’ total sales distribution is estimated in the order of mobile (54%), HPC (19%), and automotive (11%).

Compared to a decade ago, when Samsung Electronics heavily relied on mobile and consumer electronics segments, the company has diversified its revenue streams significantly. Rapid advancements in various divisions, coupled with building client trust in the industry, have empowered the Korean giant to expand into new markets, especially with the growing momentum in “generative AI.”