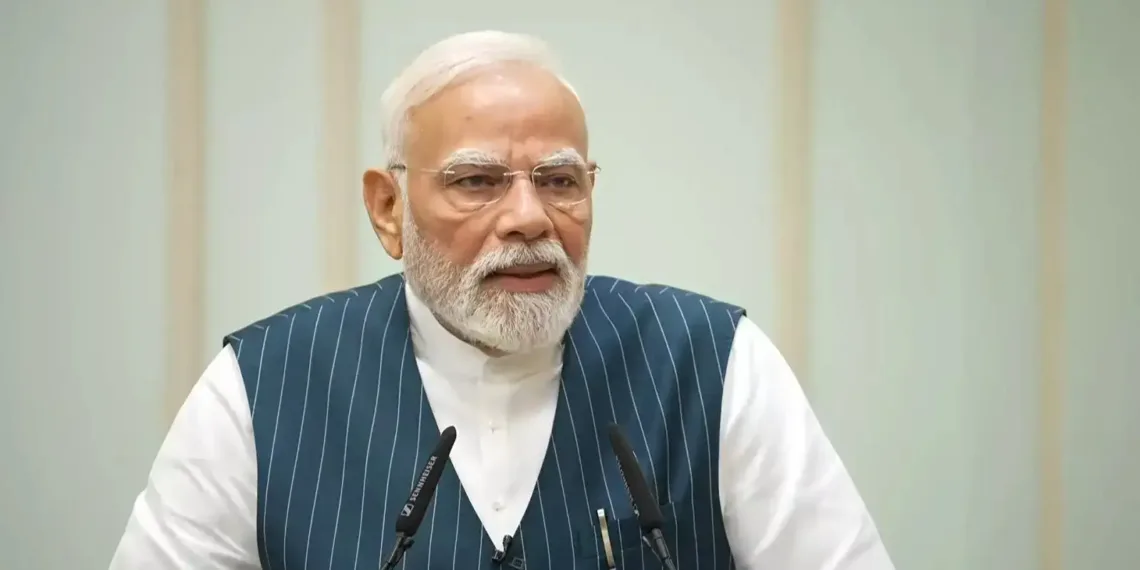

Prime Minister Narendra Modi will address the nation at 5 PM today, September 21, just a day before the rollout of major GST reforms. This strategic timing suggests the address will likely focus on the government’s ambitious tax restructuring plans that promise to reshape India’s economic landscape.

Table of Contents

What to Expect from Today’s Address

The timing is no coincidence. The GST Council on September 3, 2025 announced rationalisation of GST slab structure by abolishing 12% and 28% tax slabs, introducing a simplified system that could benefit millions of businesses and consumers across India.

India’s GST system has been overhauled into a simpler two-tier rate structure of 5% and 18%, while luxury and sin goods are now taxed at 40%—a dramatic departure from the previous complex multi-slab system.

Key Details: PM Modi Address Schedule

| Aspect | Details |

|---|---|

| Date | Sunday, September 21, 2025 |

| Time | 5:00 PM IST |

| Platform | All India Radio, Doordarshan, Digital Channels |

| Expected Topic | GST Reforms & Economic Policy |

| Implementation | Monday, September 22, 2025 |

Revolutionary GST Changes Taking Effect Tomorrow

The reforms represent the most significant tax restructuring since GST’s original implementation. 99% of items in the 12% slab will move to 5%, and 90% of those in the 28% slab will reduce to 18%, potentially saving consumers billions in tax burden.

Major Beneficiaries Include:

- Daily essentials and FMCG products

- Healthcare and medicines

- Consumer durables like refrigerators and washing machines

- Packaged foods and beverages

- Small vehicles and auto parts

For comprehensive coverage of India’s economic policies and government announcements, visit TechnoSports Political News.

Why This Address Matters Now

PM Modi’s addresses to the nation typically occur during moments of national significance. The GST 2.0 reforms represent one of the government’s most ambitious economic initiatives since taking office, promising to:

- Simplify tax compliance for businesses

- Reduce costs for consumers

- Boost economic growth through increased consumption

- Strengthen digital infrastructure for tax collection

The Prime Minister’s Office has maintained that these reforms will make India more competitive globally while ensuring tax benefits reach the common man.

Industry and Public Reaction

Business communities across India are eagerly awaiting the PM’s address, hoping for clarity on implementation timelines and transition support. A new 40% GST slab has been introduced for luxury goods like premium cars and bikes, and sin goods like cigarettes and tobacco, suggesting the government’s commitment to progressive taxation.

The reforms are expected to particularly benefit:

- Small and medium enterprises (SMEs)

- Manufacturing sector

- Consumer goods companies

- Export-oriented businesses

Stay updated with real-time political developments and policy changes at TechnoSports India News.

Digital Platform Availability

The address will be broadcast live across multiple platforms, ensuring maximum reach. Citizens can tune in through traditional media or access digital streaming options for real-time updates on these historic economic changes.

As India positions itself for rapid economic growth, today’s address could mark a pivotal moment in the country’s fiscal policy evolution, potentially setting the stage for sustained economic expansion in the coming years.

Follow TechnoSports for live updates on PM Modi’s address and comprehensive analysis of India’s GST reforms. Don’t miss our expert commentary and real-time political coverage.

Frequently Asked Questions

Will the New GST Rates Actually Reduce Prices for Common Items?

Yes, the simplified GST structure will significantly reduce prices for everyday items. With 99% of goods moving from the 12% slab to 5%, and most 28% items dropping to 18%, consumers should see immediate price reductions on essentials like packaged foods, medicines, and household goods. However, luxury items will face higher 40% rates, ensuring the tax burden shifts toward premium consumption while providing relief to middle-class families.

How Will Small Businesses Benefit from These GST Reforms?

Small and medium enterprises will experience substantial compliance relief through the simplified two-tier structure. With fewer tax slabs to navigate, businesses can reduce accounting complexities, lower compliance costs, and focus more on growth rather than tax calculations. The reduced rates on raw materials and intermediate goods will also improve cash flow and reduce working capital requirements for smaller manufacturers and retailers.