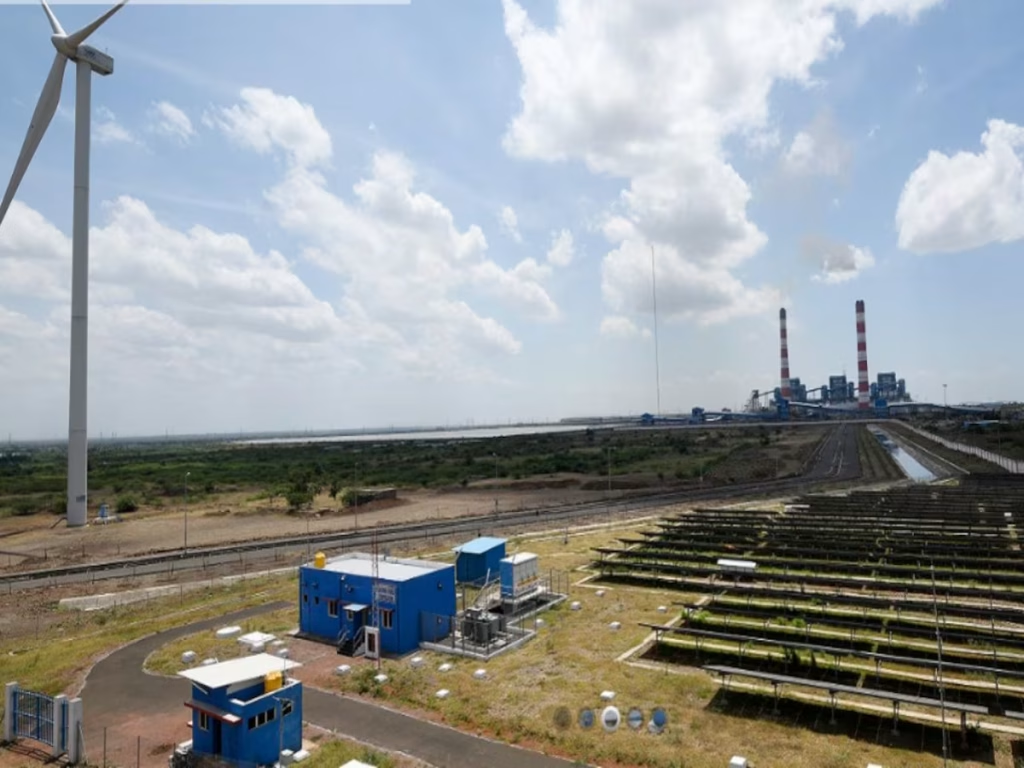

NTPC Green Energy Ltd, a subsidiary of energy giant NTPC, marks its historic entry into the Indian stock market on November 27, 2024. This ₹10,000-crore IPO represents a significant milestone in India’s renewable energy sector, ranking as 2024’s third-largest public offering after Hyundai Motor India and Swiggy.

Table of Contents

The company’s recent joint venture with Maharashtra State Power Generation Company demonstrates its commitment to expansion. With ambitious growth targets and strong institutional backing, NTPC Green Energy is positioned to play a pivotal role in India’s renewable energy transformation. However, investors should consider the competitive nature of the sector and potential market volatility when making investment decisions.

NTPC Green Energy: Pre-listing Indicators

Grey Market Performance

- Current GMP: ₹1 (0.93% premium over issue price)

- Price Band: ₹102-108 per share

- Market Sentiment: Cautiously optimistic

Subscription Details

- Retail Investors: 3.44x oversubscribed

- Qualified Institutional Buyers: 3.32x oversubscribed

- Non-Institutional Investors: 0.81x subscribed

Company Strengths

Operational Capacity

- Solar Projects: 3,220 MW

- Wind Projects: 100 MW

- Geographic Presence: 6 states

- Average PPA Duration: 25 years

- Development Pipeline: 13,576 MW contracted

- Future Target: 60 GW by FY32

Financial Performance

- Revenue CAGR (FY22-24): 46.82%

- FY24 Revenue: ₹1,963 crore

- PAT Margin: 17.56%

- ROE: 17.76%

Expert Recommendations

Investment Strategy

- Long-term Perspective: Hold recommended

- Partial Profit Booking: Consider at 8-10% gains

- New Investors: Accumulate near issue price

Read More: Adani Energy Solutions Share Price Plunges: Understanding the 28% Drop

FAQs

Q1: What makes NTPC Green Energy a significant IPO in the renewable energy sector?

NTPC Green Energy is the largest renewable energy public sector enterprise (excluding hydro) in India by operating capacity. Its strategic importance lies in its robust portfolio, established parent company backing, and crucial role in India’s renewable energy transition.

Q2: How should investors approach NTPC Green Energy shares post-listing?

Analysts recommend a long-term investment approach due to the company’s strong fundamentals and growth potential. While short-term volatility may exist, the renewable energy sector’s growth prospects make it an attractive long-term investment.