New GST Rates 2025: The GST Council has made a landmark decision that will reshape India’s tax landscape. Finance Minister Nirmala Sitharaman announced the approval of simplified new GST rates, with the Council deciding to abolish the 12% and 28% slabs and shift most items into just 5% and 18% categories, effective September 22, 2025.

This major tax reform, promised by Prime Minister Modi in his Independence Day speech, represents the most significant overhaul of India’s GST structure since its inception in 2017.

Table of Contents

What Are the New GST Rates?

The new GST rates structure will be dramatically simplified from the current five-slab system to a more streamlined approach:

Current vs New Rate Structure

| Current GST Slabs | New GST Rates (Sept 22, 2025) | Impact |

|---|---|---|

| 0% (Exempt items) | 0% (Continues) | No change |

| 5% (Essentials) | 5% (Expanded coverage) | More items included |

| 12% (General goods) | Abolished | Items moved to 5% or 18% |

| 18% (Standard rate) | 18% (Retained) | Broader item coverage |

| 28% (Luxury goods) | Abolished | Items redistributed |

| – | 40% (New slab) | Sin goods only |

#WATCH | Delhi: After 56th GST Council meeting, Punjab Minister Harpal Singh Cheema says, "Now there are three slabs – 5%, 18% and a special slab. One slab has been removed. We said the compensation cess should be increased, but the Centre did not agree." pic.twitter.com/MijtGSLUKs

— ANI (@ANI) September 3, 2025

Key Highlights of New GST Rates Reform

Major Changes Include:

- Simplified Structure: Removal of the 12% and 28% tax slabs, simplifying GST into two primary slabs: 5% and 18%

- Sin Goods Tax: A new 40% slab exclusively for sin and luxurious goods like tobacco and high-end luxury items

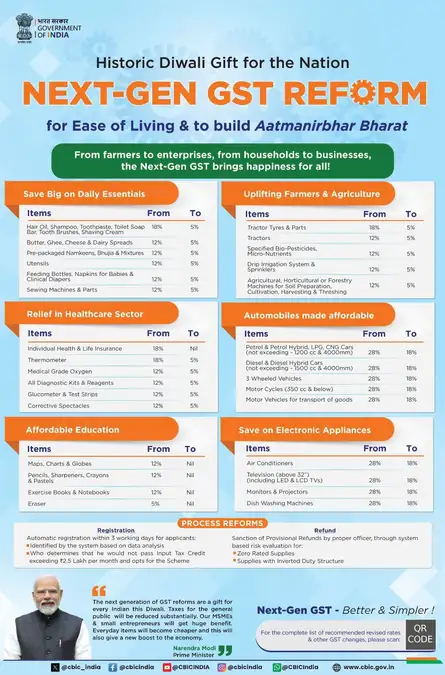

- Healthcare Relief: Exemption of health and life insurance premiums for individuals from GST, which currently attracts 18% GST

Items Getting Cheaper Under New GST Rates

The reform is expected to benefit consumers significantly:

Essential Goods: Many items currently in the 12% bracket will move to the 5% category, making daily necessities more affordable.

Consumer Products: Several goods from the 28% slab will be redistributed to lower tax brackets, reducing prices for middle-class families.

Insurance: Complete GST exemption on health and life insurance premiums will provide substantial savings for policyholders.

Implementation Timeline

The new GST rates will take effect from September 22, 2025, giving businesses and consumers time to prepare for the transition. This timing aligns with the festive season, potentially boosting consumer spending during Diwali.

Impact on Businesses and Economy

Benefits for Businesses:

- Simplified Compliance: Fewer tax slabs mean easier GST return filing

- Reduced Confusion: Clear rate structure eliminates classification disputes

- Lower Administrative Costs: Streamlined processes reduce compliance burden

Economic Advantages:

- Increased Consumption: Lower prices on essential goods boost demand

- Revenue Efficiency: Better tax collection through a simplified structure

- Business Growth: Reduced compliance costs, freeing up capital for expansion

What This Means for Taxpayers

The new GST rates system brings several advantages:

- Price Reductions: Many everyday items will become cheaper

- Insurance Savings: Complete exemption from health insurance premiums

- Simplified Shopping: Clearer pricing structure for consumers

- Festive Benefits: Implementation before Diwali provides timely relief

Expert Analysis

Tax experts view this as India’s most significant indirect tax reform since GST implementation. The move addresses long-standing concerns about rate complexity while maintaining revenue neutrality through the strategic introduction of the 40% sin goods category.

The reform aligns with global best practices of maintaining fewer tax slabs for better compliance and economic efficiency.

#WATCH | Delhi: After 56th GST Council meeting, Himachal Pradesh Minister Rajesh Dharmani says, "Unanimously, everyone has agreed in favour of GST rate rationalisation. Now there will be three slabs. Effectively, it will be 5% and 18% percent. 12% and 28% have been abolished.… pic.twitter.com/aErWs2n2D0

— ANI (@ANI) September 3, 2025

Looking Ahead

As businesses prepare for the September 22 implementation, the government is working on detailed guidelines for item categorization. The reforms also include plans for pre-filled GST returns, faster refunds, and smoother MSME registrations as part of GST 2.0.

This historic decision marks a new chapter in India’s tax administration, promising simplified compliance and economic benefits for millions of businesses and consumers across the country.

Read More- TV Actor Ashish Kapoor Arrested in Pune: What We Know About the Rape Case

Stay updated with the latest GST developments through official channels: Press Information Bureau and GST Council Official Website

For detailed GST rate information, visit: ClearTax GST Rates