The tax filing season just got a major disruption. JioFinance has launched an Income Tax Return (ITR) filing service starting at just ₹24, making it the most affordable tax filing option in India. But is this too good to be true?

Table of Contents

What JioFinance’s ₹24 ITR Service Offers

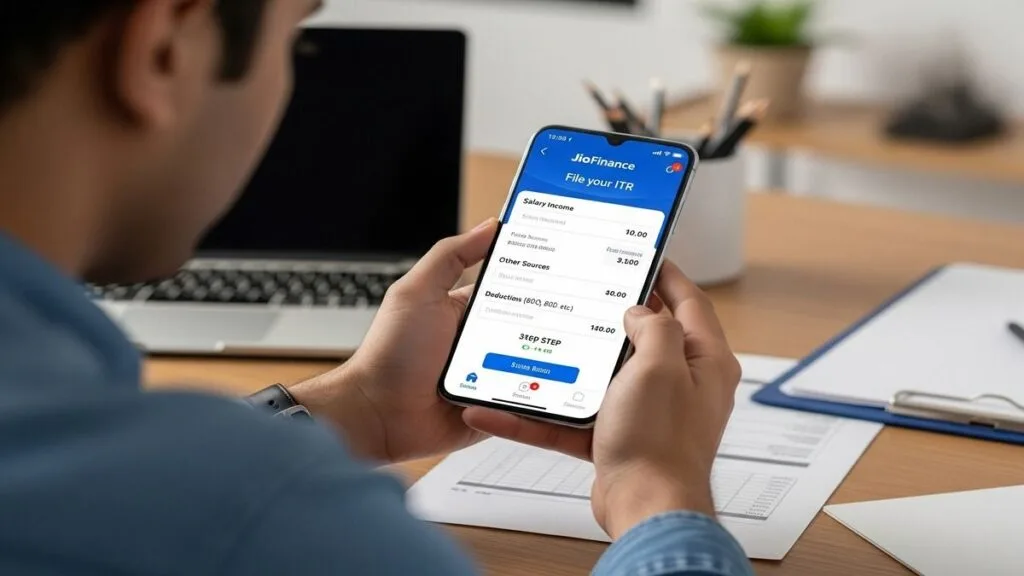

Jio Finance, in collaboration with TaxBuddy, has launched this service through its JioFinance app, targeting salaried individuals and first-time taxpayers. The platform promises a simple, guided tax filing experience at an unprecedented price point.

Service Pricing Structure

| Service Type | Price | Features |

|---|---|---|

| Self-Service Basic | ₹24 | ITR-1 filing for salaried individuals |

| Expert Assisted | ₹999+ | Professional help for complex returns |

| Premium Plans | Variable | Advanced tax planning and consultation |

Source: JioFinance Official Documentation

The Reality Behind the ₹24 Price Tag

While the pricing seems revolutionary, it’s limited to basic ITR-1 returns with no expert review or CA support. Tax experts are raising concerns about what users might be missing.

What You Get for ₹24

- Self-service ITR-1 filing for salaried employees

- Basic form filling with guided steps

- Digital submission to Income Tax portal

- Return tracking facility

What’s Missing

- Expert review of your tax return

- Chartered Accountant consultation

- Complex deduction optimization

- Advanced tax planning advice

The Hidden Economics: Why So Cheap?

₹24 barely covers the payment gateway fee for Jio, as tax-filing platforms have real costs including API integration, servers, customer support, and data compliance. This raises questions about the business model.

Industry analysts suggest this could be part of a larger strategy to:

- Acquire customer data for financial services

- Build market share in fintech sector

- Cross-sell other financial products

- Establish ecosystem dominance

For comprehensive tax planning strategies, check our expert tax guides and financial planning resources.

Who Should Consider This Service?

Ideal Candidates

- First-time tax filers with simple salary income

- Young professionals with basic tax situations

- Budget-conscious users seeking affordable filing

- Tech-savvy individuals comfortable with self-service

Who Should Avoid

- Business owners with complex income streams

- Investors with capital gains and multiple investments

- High-net-worth individuals requiring detailed planning

- Those needing expert consultation

Expert Concerns and Warnings

Tax experts warn this might be more about data harvesting than benevolent service. The ultra-low pricing model raises sustainability questions and potential privacy concerns.

Key Concerns

- Data Privacy: What happens to your sensitive financial information?

- Service Quality: Can quality be maintained at such low prices?

- Long-term Viability: Is this pricing sustainable?

- Hidden Costs: Are there additional charges later?

Learn more about protecting your financial data and choosing the right tax service.

Comparison with Traditional Services

Traditional CA services typically charge ₹1,500-₹5,000 for ITR filing, while online platforms charge ₹500-₹2,000. JioFinance’s ₹24 pricing is indeed disruptive, but comes with service limitations.

The Verdict: Worth It or Not?

For simple salaried individuals with straightforward tax situations, the ₹24 service could be adequate. However, if you have investments, multiple income sources, or need expert advice, investing in professional services remains advisable.

The official Income Tax Department recommends using certified tax professionals for complex returns and provides free filing options for simple cases.

Stay updated with the latest fintech innovations and tax filing tips through our financial technology section and tax planning hub.

Frequently Asked Questions

Q1: Is JioFinance’s ₹24 ITR filing service legitimate and safe?

A: Yes, the service is legitimate as JioFinance is a registered financial services company partnering with TaxBuddy. However, it’s limited to basic ITR-1 returns for salaried individuals. The safety concerns revolve around data privacy and the lack of expert review, which might lead to errors in complex tax situations.

Q2: What are the limitations of the ₹24 ITR filing service compared to professional CA services?

A: The ₹24 service is purely self-service with no expert consultation, limited to simple salary income (ITR-1), and doesn’t include tax optimization advice. Professional CA services provide expert review, handle complex deductions, offer tax planning strategies, and ensure compliance accuracy, though at higher costs starting from ₹999.