On Thursday, Intel Corp (INTC.O) said it expects to lose money in the current quarter, surprising investors with a bleaker-than-expected outlook for both the PC market and its key data centre division. After-hours trading saw a 9.5% drop in the company’s stock.

After two years of strong growth as remote work boomed during the pandemic, two of Intel’s most important markets are showing signs of weakness. Now, the PC industry is dealing with a chip glut as consumer electronics demand plummets and business customers fearful of a recession cut back on data centre spending.

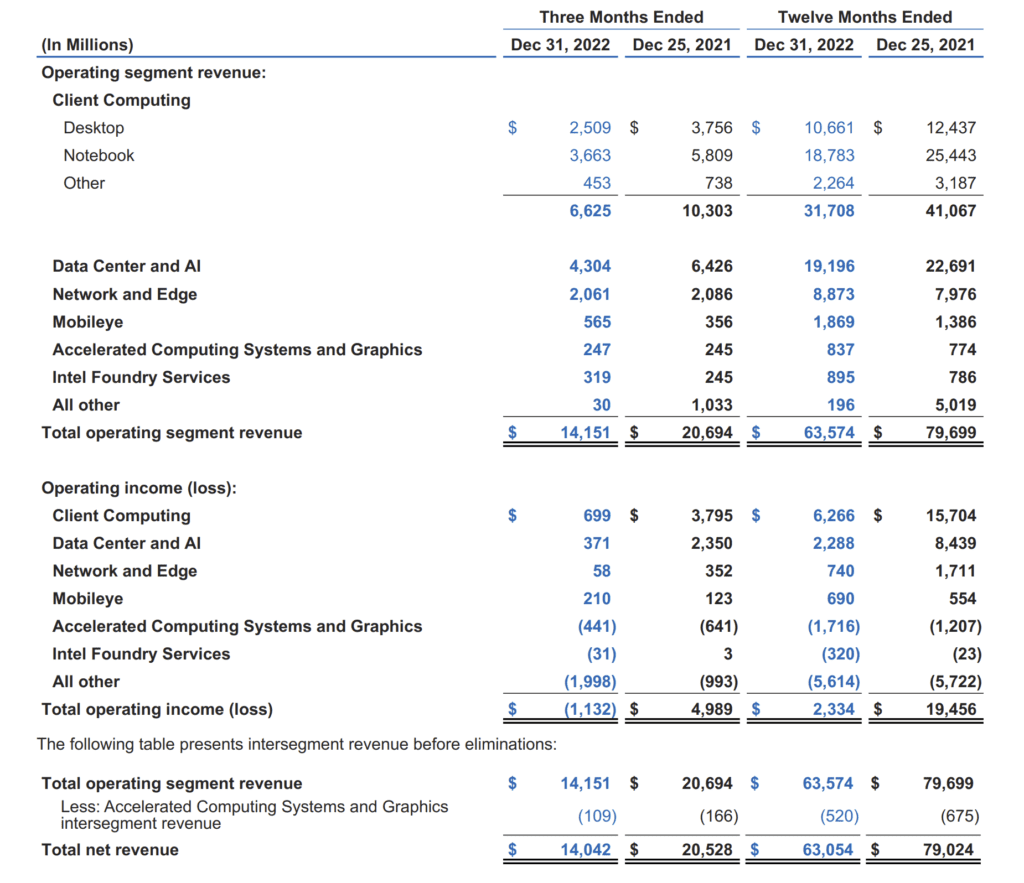

Intel anticipates that profit margins will fall further, from 58.4% in the fourth quarter of 2020 to 43.8% in the fourth quarter of 2022. Intel reiterated its medium-term gross margin target of 51-53%, with a longer-term target of 54-58%.

Intel has focused on regaining the lead in chipmaking technology since Gelsinger’s return nearly two years ago.

Outsourcing the chipmaking process has enabled competitors such as AMD to produce much smaller and faster chips, outpacing Intel’s technology. The company expects first-quarter revenue to be in the $10.5 billion to $11.5 billion range. According to Refinitiv data, analysts expected total revenue of $13.93 billion. The company anticipates an adjusted loss of 15 cents per share, compared to a profit of 24 cents per share.

Revenue fell 32% to $14 billion in the fourth quarter. Analysts expect revenue of $14.46 billion on average. Other microchip companies’ shares fell as well, with AMD down 2.6% and Nvidia Corp (NVDA.O) down 2%. Reduced PC demand also put pressure on Microsoft Corp’s (MSFT.O) More Personal Computing segment, which includes Windows, devices, and search revenue, resulting in a 19% drop in revenue in the second quarter.

Also Read: