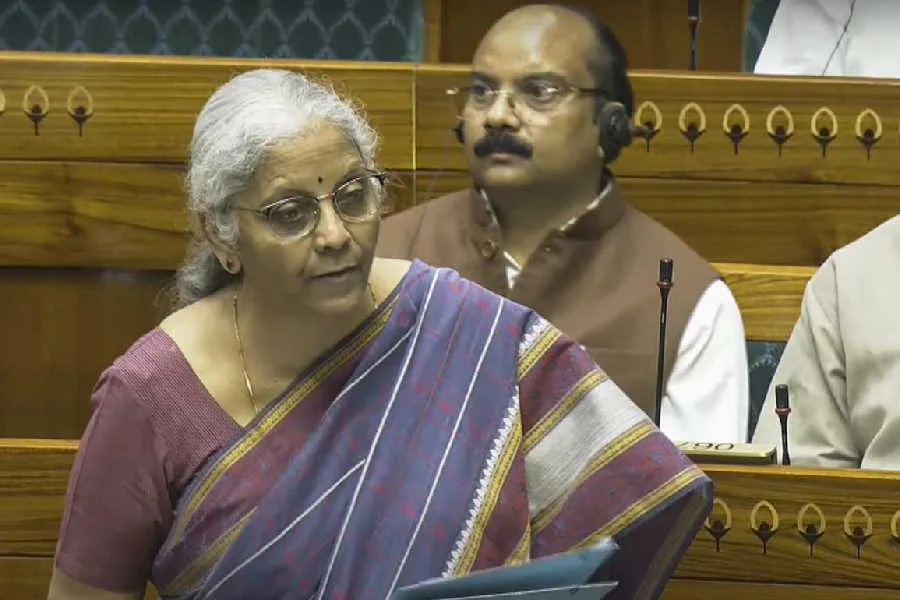

India’s insurance sector is set for a revolutionary transformation as Finance Minister Nirmala Sitharaman announced that raising the FDI limit in Indian insurance companies to 100 percent would bring more players into the market and generate employment opportunities. This groundbreaking policy shift, detailed during the Monsoon Session of Parliament on August 12, 2025, marks a significant departure from the previous 74% cap.

Table of Contents

FDI Insurance Policy: Key Details at a Glance

| Aspect | Details |

|---|---|

| Previous FDI Limit | 74% |

| New FDI Limit | 100% |

| Announcement Date | Union Budget 2025 (February 1) |

| Parliamentary Update | August 12, 2025 |

| Key Benefit | Employment Generation |

| Market Impact | Increased Competition |

| Implementation | Pending Legislative Approval |

| Sector Focus | Complete Insurance Market Opening |

The Employment Generation Promise

During the Monsoon Session of Parliament on August 12, 2025, Finance Minister Nirmala Sitharaman outlined key advantages of increasing the Foreign Direct Investment (FDI) limit in Indian insurance companies from 74% to 100%. The minister emphasized that this strategic move would significantly boost job creation across the sector.

Direct Employment Impact

This move aims to enhance market competition, employment, and technological improvements, creating a multiplier effect throughout the insurance ecosystem. From underwriters to claims processors, customer service representatives to actuaries, the sector is poised for substantial workforce expansion.

Market Transformation and Global Player Entry

The government seeks to fully unlock the potential of India’s insurance industry, and has announced opening up of the sector to 100 per cent FDI. This policy change is expected to attract major international insurance players who were previously limited by ownership restrictions.

Competitive Landscape Evolution

The increase from 74% to 100% removes significant barriers for foreign insurers, potentially leading to India could be on the path to having 1,000 insurers as market dynamics shift dramatically. This competition will benefit consumers through better services, innovative products, and competitive pricing.

Technology and Innovation Boost

Raising FDI in Indian insurance firms from 74 percent to 100 percent will bring global players, create jobs, improve technology, and ensure better services while keeping policyholder protection rules intact. International players typically bring cutting-edge technology, digital platforms, and advanced analytics capabilities.

Digital Transformation Acceleration

Foreign insurers often introduce sophisticated digital platforms, AI-driven underwriting processes, and innovative customer service solutions that can revolutionize the traditional Indian insurance landscape.

Budget 2025: Strategic Financial Sector Reforms

Union Budget 2025 increased the sectoral cap of insurance sector to 100% from 74% as part of broader financial sector reforms. This policy aligns with India’s vision of becoming a global financial hub and increasing insurance penetration across the country.

Six-Domain Transformative Approach

The insurance FDI increase forms part of Budget 2025-26’s transformative reforms across six domains designed to augment economic growth and modernize India’s financial services sector.

Regulatory Safeguards and Policyholder Protection

Regulations ensure that funds remain invested in India, with strict guidelines to protect policyholders. The government has maintained robust regulatory frameworks to ensure that increased foreign participation doesn’t compromise consumer interests.

Balanced Liberalization Approach

The policy maintains essential safeguards while opening markets, ensuring that increased competition benefits consumers without compromising financial stability or policyholder security.

For more insights into India’s economic policies and financial sector developments, explore our comprehensive coverage at TechnoSports.

Industry Expert Perspectives

Financial sector analysts view this move as a watershed moment for Indian insurance, potentially transforming market dynamics and service delivery standards. The policy addresses long-standing issues of limited competition and underinsurance in various segments.

Market Penetration Potential

India, with its vast and diverse population, has immense untapped potential in insurance, making it an attractive destination for global insurers seeking growth opportunities in emerging markets.

Implementation Timeline and Next Steps

This move was followed by a public consultation initiated by the Ministry of Finance in November 2024 on the Insurance Laws (Amendment), indicating systematic preparation for this significant policy shift. Legislative amendments and regulatory framework updates are expected to follow.

Economic Impact and Growth Projections

The policy change is expected to boost India’s insurance sector GDP contribution, enhance financial inclusion, and strengthen the overall financial services ecosystem. Increased competition typically leads to product innovation and improved customer service standards.

Conclusion

Finance Minister Nirmala Sitharaman’s announcement of 100% FDI in insurance represents a bold step toward modernizing India’s financial sector. Union Minister of Finance Ms. Nirmala Sitharaman announced a proposed hike in insurance sector FDI to 100%, aiming to boost growth and penetration, while simultaneously creating substantial employment opportunities.

This policy shift from 74% to 100% FDI will likely transform India’s insurance landscape, bringing global expertise, advanced technology, and increased competition that ultimately benefits consumers and the broader economy.

Frequently Asked Questions

Q1: What are the main benefits of raising India’s insurance FDI limit to 100%?

A: The key benefits include significant employment generation, enhanced market competition, and technological improvements. Finance Minister Nirmala Sitharaman informed Parliament that raising the FDI limit to 100 percent would bring more players into the market and generate employment opportunities. This policy will bring global players, create jobs, improve technology, and ensure better services while keeping policyholder protection rules intact. The increased competition is expected to lead to better products, lower premiums, and improved customer service across the insurance sector.

Q2: When was this 100% FDI policy announced and what was the previous limit?

A: Union Budget 2025 increased the sectoral cap of insurance sector to 100% from 74%, announced on February 1, 2025. During the Monsoon Session of Parliament on August 12, 2025, Finance Minister Nirmala Sitharaman outlined key advantages of increasing the Foreign Direct Invest