India’s electronics industry just got its biggest boost in years. The Government’s recent GST rate restructuring isn’t just another policy change – it’s a game-changer that’s already reshaping how we think about buying everything from smartphones to smart TVs. And judging by industry leaders’ reactions, this could be the catalyst India’s tech sector has been waiting for.

Table of Contents

What GST 2.0 Actually Means

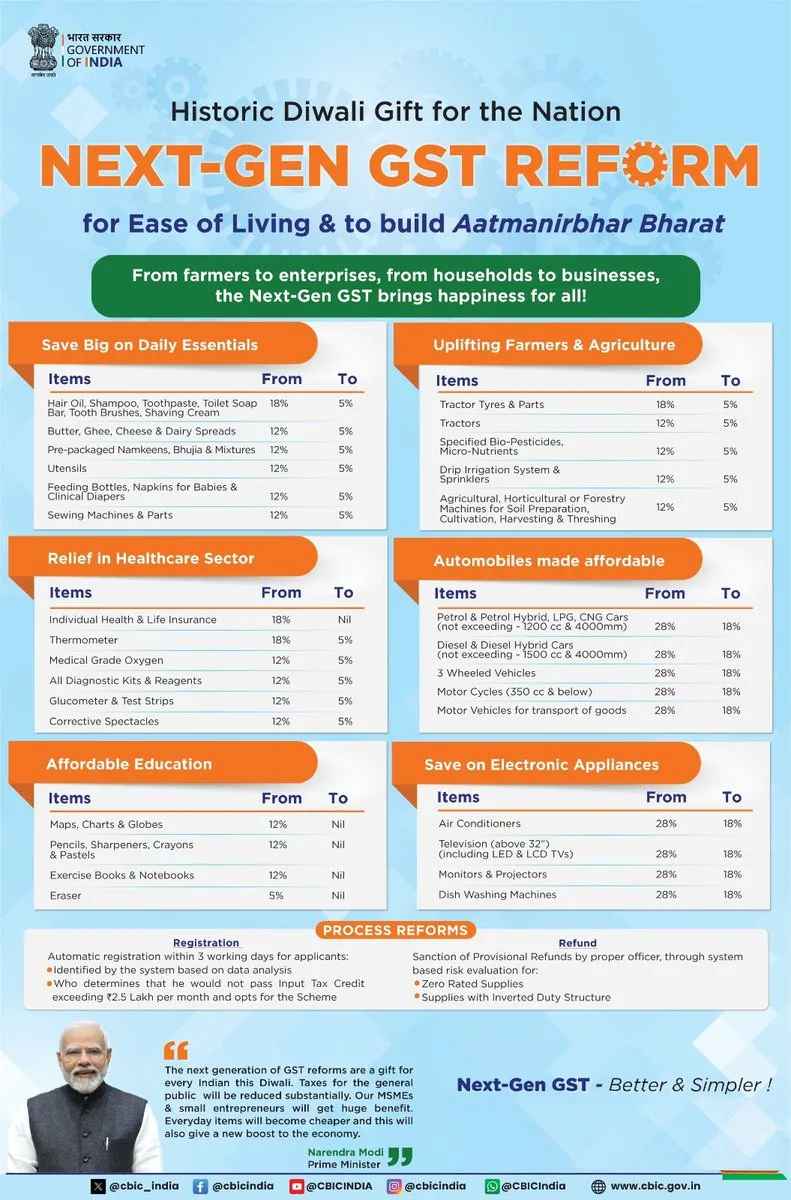

The new two-tier GST structure (5% and 18%) replaces the complex multi-slab system that had businesses and consumers confused for years. For electronics buyers, this translates to immediate price reductions on everything from monitors and projectors to air conditioners and lithium-ion batteries.

Mr. Gagan Sharma, Managing Director of XElectron, captures the excitement perfectly: “The GST 2.0 is a welcome step for both consumers and brands like ours. It not only reduces the cost burden of purchasing lifestyle electronics such as TVs and projectors but also encourages customers to opt for higher-end, larger-screen models that are often considered luxury items.”

Industry Leaders Speak: The Real Impact

| Company | Leader | Key Insight |

|---|---|---|

| BenQ India | Rajeev Singh | Simplified compliance, reduced supply chain costs |

| Cellecor | Ravi Agarwal | 18% uniform rate creates level playing field |

| CP PLUS | Aditya Khemka | Makes advanced security solutions more accessible |

| Hisense India | Pankaj Rana | Opens Tier-2, Tier-3 markets for premium products |

| HMD Global | Ravi Kunwar | Improved operational efficiency, cost predictability |

| XElectron | Gagan Sharma | Festive season timing creates perfect market opportunity |

Perfect Timing for Festive Shopping

What makes this reform particularly smart is its timing. With the festive season approaching, Gagan Sharma from XElectron notes: “The timing makes this move even more impactful, as the revised rates will come into effect during the festive season, when people actively purchase and gift electronics, giving a boost to the consumer electronics market.”

This isn’t coincidental. The government clearly understands that festive seasons drive massive electronics purchases, and lower prices during this period could create a consumption boom.

Breaking Down the Benefits

For Consumers

- Lower prices across popular electronics categories

- Simplified tax structure makes price comparison easier

- Premium products become more accessible to middle-class buyers

- Festive season purchases get more affordable

For Manufacturers

- Reduced compliance complexity streamlines operations

- Uniform 18% rate on key components like lithium-ion batteries

- Supply chain cost reduction improves margins

- Competitive pricing becomes easier to achieve

Winners Across the Board

Ravi Agarwal from Cellecor highlights how this impacts the entire ecosystem: “The alignment of GST on lithium-ion batteries at 18% will have a direct impact on the ecosystem of wireless, portable, and smart devices by reducing input costs across the value chain.”

This ripple effect means everything from smartphone accessories to smart home devices becomes more affordable.

Regional Market Expansion

Pankaj Rana from Hisense India points out a crucial advantage: “These reforms enable a larger and more diverse consumer base, especially in emerging markets and Tier-2 and Tier-3 cities, to access high-quality, energy-efficient products.”

This democratization of premium electronics could accelerate digital adoption in rural India, supporting the government’s broader digitization goals.

Supporting Atmanirbhar Bharat

Aditya Khemka from CP PLUS connects these reforms to India’s self-reliance vision: “The overall direction supports affordability, faster adoption, and strengthens the government’s vision of Atmanirbhar Bharat by boosting local manufacturing and value creation.”

By making Indian-made electronics more competitive, GST 2.0 could accelerate the shift from imports to domestic manufacturing.

What This Means for Your Next Purchase

Whether you’re eyeing that 65-inch smart TV, considering a home projector setup, or planning to upgrade your laptop, GST 2.0 makes this the perfect time to buy. XElectron’s Gagan Sharma emphasizes: “At XElectron, we offer innovative products such as smart projectors, LED TVs, digital photo frames, and monitors, and this change ensures that consumers can now enjoy them at even more attractive prices, especially for festive gifting.”

The Bottom Line

GST 2.0 isn’t just a tax reform – it’s a catalyst for India’s electronics industry growth. From simplified compliance for manufacturers to lower prices for consumers, everyone wins. And with festive season timing, this could trigger the biggest electronics buying spree India has seen in years.

Ready to upgrade your tech setup? This might be the best opportunity you’ll get this decade.

Stay informed about the latest government policy impacts and electronics industry trends as India’s digital transformation accelerates.