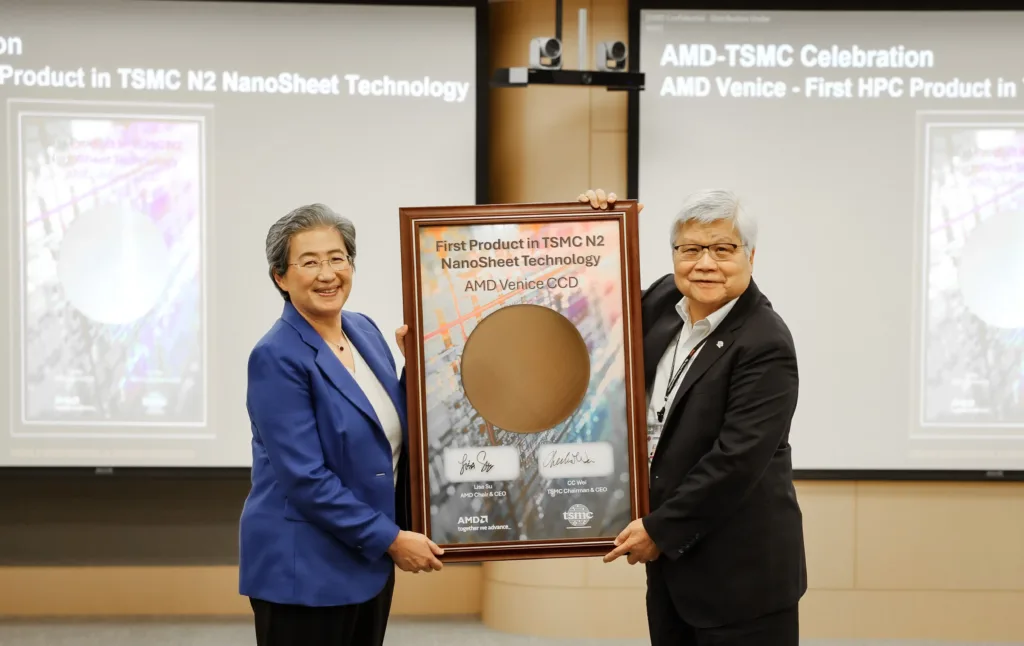

AMD CEO Lisa Su has disclosed that sourcing AI chips from TSMC’s US manufacturing facilities costs 5-20% more than Taiwan operations, highlighting the significant financial challenges of building domestic semiconductor supply chains. Speaking at an AI event in Washington, Su emphasized that despite higher costs, major tech companies have no alternative, as Taiwan facilities operate at full capacity.

Table of Contents

Cost Analysis: US vs Taiwan Manufacturing

The price differential between TSMC’s US and Taiwan operations reveals the complexities of semiconductor supply chain localization:

| Cost Factor | Taiwan Operations | US Operations (Arizona) | Price Impact |

|---|---|---|---|

| Manufacturing Cost | Baseline pricing | 5-20% premium | Significantly higher |

| Labor Expenses | Lower regional costs | Premium US wages | Major cost driver |

| Equipment Import | Established infrastructure | Higher setup costs | Additional expense |

| Supply Chain Maturity | Decades of optimization | Developing ecosystem | Efficiency gap |

Source: AMD CEO Lisa Su’s comments reported by Bloomberg at the Washington AI event.

Why US Chip Production Costs More

Labor Premium: Higher US wages represent a significant cost factor compared to Taiwan’s established semiconductor workforce, contributing substantially to the 20% price increase.

Infrastructure Development: Equipment import costs and facility setup expenses in Arizona are considerably higher than expanding existing Taiwan operations with mature supply chains.

Supply Chain Immaturity: The “negligible” position of American chip supply chains before TSMC’s arrival means supporting infrastructure remains underdeveloped, creating efficiency gaps.

Market Dynamics: Full capacity utilization in Taiwan forces companies to accept premium US pricing as the only available alternative for cutting-edge node production.

AMD’s Strategic Positioning

Early Adopter Status: AMD stands as one of TSMC’s bigger US customers, placing among the first 4nm orders with the Arizona facility and securing priority access to advanced manufacturing.

Future Roadmap: AMD has committed to scaling up to 2nm production specifically for EPYC Venice data center CPUs, demonstrating long-term confidence in US manufacturing despite cost premiums.

Supply Security: The cost premium provides AMD with manufacturing diversification and supply chain resilience, critical for meeting AI chip demand without Taiwan dependencies.

Market Context & Industry Impact

No Alternative Options: Apart from Intel’s limited capacity, TSMC Arizona represents the only cutting-edge node production available in the US, creating a seller’s market with premium pricing.

Unprecedented Demand: Lisa Su reports that AI chip demand continues accelerating with partners placing orders at an “unprecedented pace”, justifying premium costs for supply security.

Market Valuation: AMD projects the total accelerator market reaching $500 billion within five years, making cost premiums manageable within rapidly expanding market opportunities.

TSMC’s US Expansion Strategy

Arizona Facility Success: TSMC has reported “massive success” with US operations despite cost challenges, indicating strong demand from major tech companies willing to pay premiums.

Capacity Constraints: Taiwan production lines operating at full capacity forces customers toward US facilities, creating natural demand for higher-priced American production.

Scale-Up Plans: TSMC intends to scale up US production further, suggesting confidence in sustained demand despite the 20% cost premium.

Supply Chain Geopolitics

Trump Administration Catalyst: The previous administration’s anti-Taiwan sourcing policies accelerated TSMC’s US expansion, creating the current manufacturing alternative.

Strategic Independence: Higher costs represent the price of supply chain independence from geopolitically sensitive Taiwan operations for critical semiconductor manufacturing.

National Security Premium: US companies accept cost increases as insurance against supply disruptions in an increasingly complex global semiconductor landscape.

Official Resources & Industry Data

Corporate Sources:

- AMD Investor Relations: amd.com/investor

- TSMC Official Information: tsmc.com

- SEC Filing Access: AMD Annual Reports

- Industry Analysis: Semiconductor Industry Association

Future Implications

Cost Evolution: As US supply chain infrastructure matures, cost premiums may decrease, though significant gaps with Taiwan operations likely persist long-term.

Competitive Dynamics: The 20% premium affects competitive positioning for AMD and other fabless companies, requiring careful cost management in product pricing strategies.

Investment Justification: For data center and AI applications with high value propositions, the cost premium remains economically justified despite margin pressure.

Market Development: Lisa Su’s projections of a $500 billion accelerator market suggest cost premiums become proportionally smaller within expanding revenue opportunities.

This revelation highlights the complex economics of semiconductor supply chain localization, where strategic security and supply resilience command significant premium pricing in the current geopolitical environment.

Follow the latest AMD developments and semiconductor industry analysis on TechnoSports for comprehensive coverage of chip manufacturing trends and supply chain dynamics.