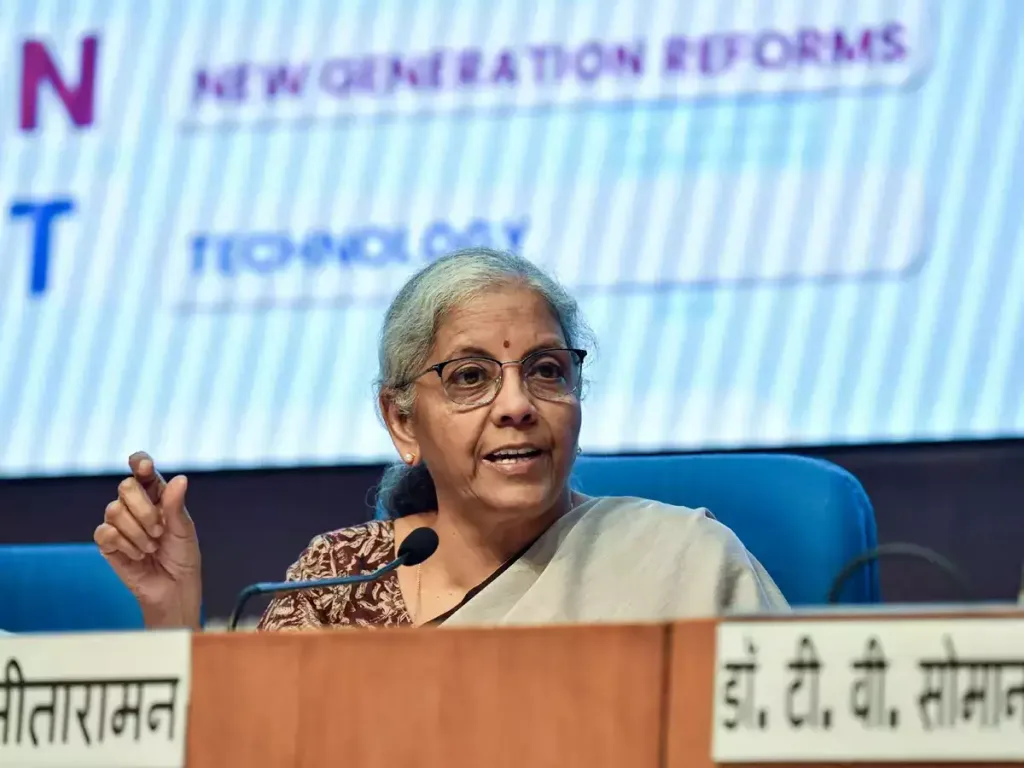

Finance Minister Nirmala Sitharaman made a compelling case for more affordable bank interest rates during her address at the prestigious 11th SBI Banking & Economics Conclave. Her remarks come at a crucial time when industries are seeking support for capacity building and expansion.

Table of Contents

The government remains committed to positioning India as the world’s third-largest economy. With a focus on balanced growth, financial inclusion, and economic stability, the administration continues to monitor both domestic and global factors while maintaining a proactive stance on policy interventions.

The Call for Lower Interest Rates

In a significant policy stance, Sitharaman emphasized that current borrowing costs are creating stress for industries looking to expand. “The cost of borrowing is really very stressful, and at a time when we want industries to ramp up and build capacities, bank interest rates will have to be far more affordable,” she stated, addressing the pressing need for more accessible financing options.

SBI Meet: Current Economic Landscape

Inflation Concerns

- CPI reached a 14-month high of 6.21% in October

- Core inflation remains manageable at 3-4%

- Primary concern centers on three perishable commodities

- RBI maintains repo rate at 6.5% for 20 consecutive months

Economic Indicators

- Record e-way bill generation

- Strong rural demand

- Robust PMI data for manufacturing and services

- Healthy FDI inflows in FY25

- Foreign exchange reserves cover 11.8 months of imports

Banking Sector Focus

Credit Growth Targets

- Current bank credit-to-GDP ratio: 58.7% (2023-24)

- Additional MSME lending target: ₹1.54 lakh crore

- Base MSME lending estimate: ₹4.2 lakh crore

- Future targets:

- 2025-2026: ₹6.12 lakh crore

- 2026-2027: ₹7 lakh crore

Government’s Economic Vision

The Finance Minister expressed confidence in India’s economic resilience, highlighting:

- Strong macroeconomic fundamentals

- Moderating inflation trends

- Robust external position

- Continued fiscal consolidation

- Growing consumer and business confidence

Policy Priorities

Immediate Focus Areas

- Managing perishable commodity prices

- Expanding credit access for MSMEs

- Addressing insurance mis-selling by banks

- Monitoring economic indicators

- Maintaining growth momentum

Read More: Trump Names Fox News Veteran Pete Hegseth as Defense Secretary: A Bold Choice Signals

FAQs

Q1: Why is the Finance Minister advocating for lower interest rates despite high inflation?

The Finance Minister’s stance reflects a balance between growth and inflation control. While acknowledging inflation concerns, she emphasizes that core inflation remains manageable (3-4%), and current high inflation is primarily driven by specific perishable commodities. Lower interest rates would support industrial growth and capacity building, which are crucial for long-term economic development.

Q2: What are the key economic indicators supporting India’s growth story?

Several high-frequency indicators demonstrate sustained growth:

Strong PMI data in manufacturing and services

Robust e-way bill generation

Healthy rural demand

Growing FDI inflows

Strong forex reserves covering 11.8 months of imports

Credit-to-GDP ratio showing potential for expansion