South Korea exceeded expectations in November as its exports saw a notable acceleration, driven by a resurgence in overseas sales of chips for the first time in 16 months. This development adds further evidence to the strengthening global demand. The country’s exports, ranking as the fourth-largest in Asia, recorded a year-on-year growth of 7.8%, reaching $55.80 billion. This growth rate outpaced the previous month’s increase of 5.1%, marking the swiftest expansion since July 2022 and surpassing the 4.7% gain forecast by economists in a Reuters poll.

South Korea’s Semiconductor Industry Recovery

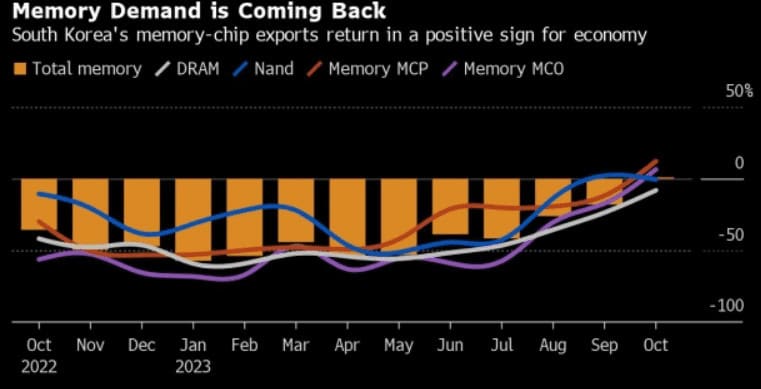

The significant rebound in chip exports, breaking a streak of 15 months of decline, showcased a 12.9% increase, hinting at a potential bottoming out of the semiconductor demand slump. Analysts, such as Lee Da Eun from Daishin Securities, attributed the export rebound to the recovering chip demand and robust car sales. The optimistic outlook extends to an anticipated overall export growth of 8% for the upcoming year. However, concerns persist about the relatively moderate momentum behind chip sales and potential downside risks from the gradual recovery of the Chinese economy.

South Korean policymakers are banking on the revival of chip demand to fuel economic growth, especially as domestic demand is curtailed by restrictive interest rates. The Bank of Korea, in response to persistent inflation risks, opted to maintain its current monetary policy unchanged, signaling a possible need to keep interest rates elevated for an extended period.

Breaking down the export destinations, sales to the United States surged by 24.7%, marking a fourth consecutive month of gains. In contrast, shipments to China, South Korea’s largest trading partner, experienced a marginal decline of 0.2%. Import figures revealed a decrease of 11.6% to $52.0 billion, slightly more than the 9.7% losses from the previous month and exceeding economists’ expectations of an 8.6% decline. Consequently, the country recorded a trade surplus of $3.80 billion in November, marking the most substantial monthly surplus since September 2021.

Notably, exports for 12 out of the country’s 15 primary export items increased in November, with a notable 38.5% surge in ship exports. Car exports also contributed to the positive trend, experiencing a substantial jump of 21.5% and extending gains for the 17th consecutive month.