It was obvious that Intel required the contract chipmaking unit to have comparable size to Samsung and Taiwan Semiconductor Manufacturing Co. since fabs and production nodes are becoming more expensive when it launched its Intel Foundry Services division in early 2021. Since the aim was set to become the second-largest foundry by 2030, the corporation appears to be planning to be somewhat aggressive as well.

Intel will have to defeat Samsung Foundry, which produced over $20 billion in sales in 2021 and is on track to surpass this figure in 2022, to move up to No. 2 on the worldwide foundry market. Samsung Foundry is currently No. 2 according to TrendForce. While far trailing market leader TSMC (53.6%) and its nearest competitors UMC (6.9%) and GlobalFoundries (5.9%), Samsung Foundry controlled roughly 16.3% of global foundry revenue as of Q1 2022.

In contrast, Intel’s IFS business division has so far this year brought in $576 million in sales. When the deal to buy Tower Semiconductor is finalised in early 2023, Intel’s IFS segment will generate an additional $1.5 billion in revenue annually. IFS will now rank No. 7 or No. 8 globally in terms of foundries, but its income will still be far lower than Samsung Foundry.

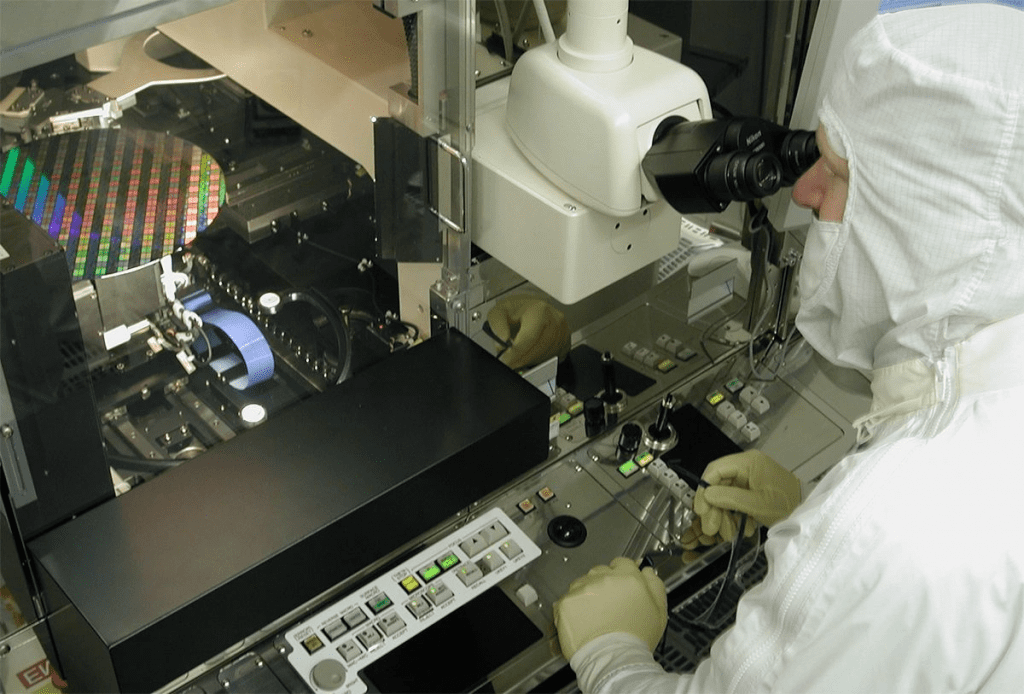

Intel has so far made public a somewhat ambitious plan for its process technology that calls for high volume manufacture of chips using its 18A (18 angstroms, or 0.18 nm-class technology) in 2025 and the use of High-NA extreme ultraviolet lithography equipment for 18A, if practicable. Samsung Foundry and TSMC both intend to begin producing 2nm-class (20 angstroms-class) processors in 2025, while Intel’s production node strategy is somewhat more aggressive (which means that these will be available in very late 2025 at the earliest, or rather in 2026).

Intel’s plans are as aggressive in terms of chip capacity.

Construction on the company’s $3.5 billion facility for advanced packaging operations, its 20A-capable Fab 52 and Fab 62 at its camp near Chandler, Arizona, its first two 18A/20A-capable modules at its site near Columbus, Ohio, its first new Intel 4-capable module at its camp near Leixlip, Ireland, and its brand-new fab near Magdeburg, Germany are all currently underway. In total, Intel aims to spend close to $100 billion on new semiconductor fabrication facilities in the upcoming years (or rather, co-invest with governments and co-investment partners like Brookfield).

Samsung, though, is equally ambitious in its CapEx spending. In reality, Samsung will invest over $33 billion in new semiconductor production capacity this year and will maintain its investment at around the same level next year, the company recently revealed, while Intel decreased its capital expenditures from $27 billion in 2022 to $25 billion recently. Of course, it is unclear how much of these funds will go toward expanding the logic capacity of Samsung Foundry versus investing in memory (3D NAND and DRAM) production facilities, but the South Korean company is obviously very aggressive with its semiconductor business, making it particularly challenging for Intel to compete with SF’s advanced capacities.

It will be more difficult to steal customers from TSMC and Samsung Foundry because major clients like Nvidia and Qualcomm have long-term supply contracts with their foundry partners. The ability of Intel’s manufacturing facilities in Europe and America to offer the same pricing as TSMC and Samsung Foundry’s manufacturing facilities in Taiwan and South Korea is also an open question.

Also Read: