As we already know, the world is dealing with a global semiconductor shortage and it has affected the supply of everyday devices from smartphones to gaming consoles to tech-dependent cars.

OEMs have addressed the issue stating that the shortage will even continue in the second half of the year and will affect the share prices of the devices in the coming months.

The major cause for the shortage of chips is that there is an increasing demand for tech gear, in large part because of the pandemic, and winter weather in Texas and a fire in Japan have added to the problem.

As the world is gripped with COVID and chip shortage, there are many company’s that have been affected, and here’s how those companies are affected.

Automakers

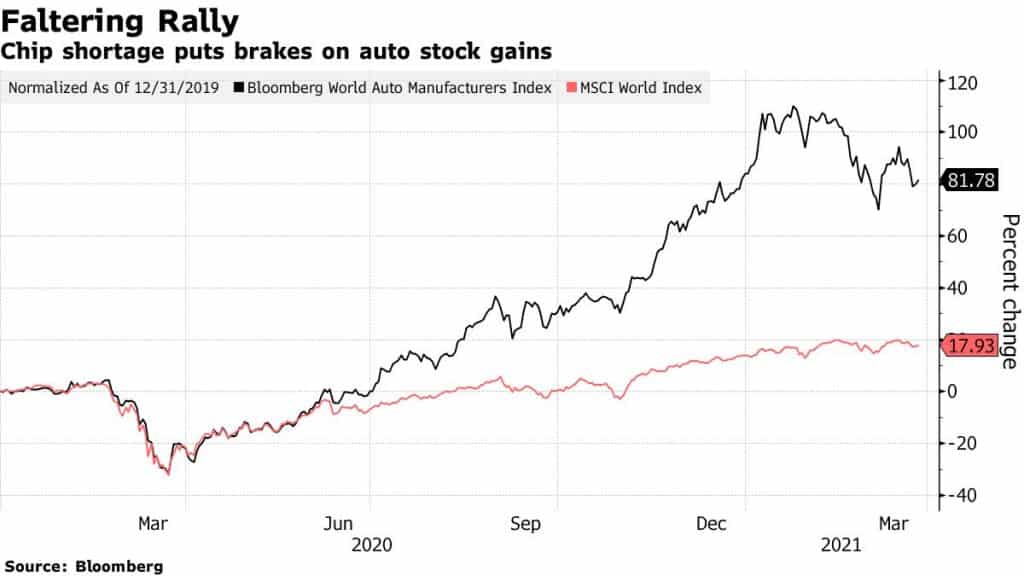

Auto-industry is one of the worst-hit industries in the market and it was recovering its business post-covid. However, now, both the chip shortage and concern over a resurgence of the coronavirus pandemic have pulled a Bloomberg index of global manufacturers down 14% from its Jan. 25 record high.

According to the latest reports, Volvo Group has slumped 7% Tuesday and has suspended its productions due to the lack of semiconductors.

“The automotive sector has arguably experienced the greatest level of disruption, with more and more OEMs either slowing production or closing manufacturing plants temporarily.”

In China, it’s Geely Automobile Holdings Ltd. slid 19% over three days last week and even the country’s Daiwa Securities cited the chip shortage in downgrading the stock and cutting estimates for this year and next.

Smartphones, Consumer Electronics

According to sources, smartphone maker Xiaomi Corp. slumped 4.4% Thursday after warning that parts shortages could slow its growth for the next few quarters. But, in the case of consumer electronics, it gives the manufacturers the power to raise prices and pass on higher costs.

“The share prices haven’t reacted particularly negatively to the news, and I think that’s because the important part is that you’re seeing a snapback in demand for these goods.”

Lenovo Group Ltd. reported earlier that it couldn’t fill all customer orders due to the lack of components. Yet, the demand for the company’s laptops is soaring because of purchases by people working at home, and the stock has doubled since August.

Sony had also earlier reported that it might be unable to fulfill the demand for its new gaming console in 2021 because of production bottlenecks. However, the company’s stock touched a 21-year high in February, though it’s dipped 8.2% since then.

Chipmakers

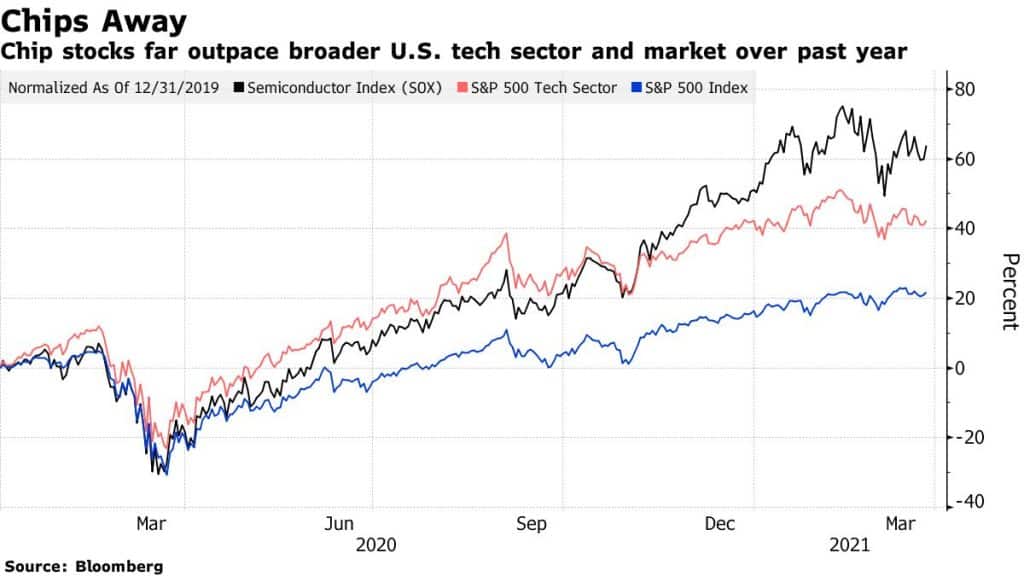

Finally coming to the industry at the center of everything, the global shortage of semiconductors has seen an increase in the value of the chip manufacturers. Most semiconductor companies are expected to report strong results for the first quarter and even in the second quarter of the year.

“This is all great news for the semiconductor vendor. This kind of tightness — of capacity utilization, rising prices, very, very strong demand — invariably means that their results are very, very strong.”

According to the share market, the European auto chip supplier Infineon Technologies AG is up 12% for the year while STMicroelectronics NV has gained just 5.6%. In the U.S., Texas Instruments Inc. is up 15%, while NXP Semiconductors NV and ON Semiconductor Corp. has done better, up 25% and 24% respectively, versus the Philadelphia Semiconductor Index’s 11% rise.

However, the winner of this crisis is the Taiwan Semiconductor Manufacturing Co. which is running at almost its full capacity to try to keep up with the surge in demand. TSMC shares are down 12% from their record set on Jan. 21 but are still up 11% on the year. It seems that global industries are relying on the Taiwanese chip manufacturer to ease their crisis.