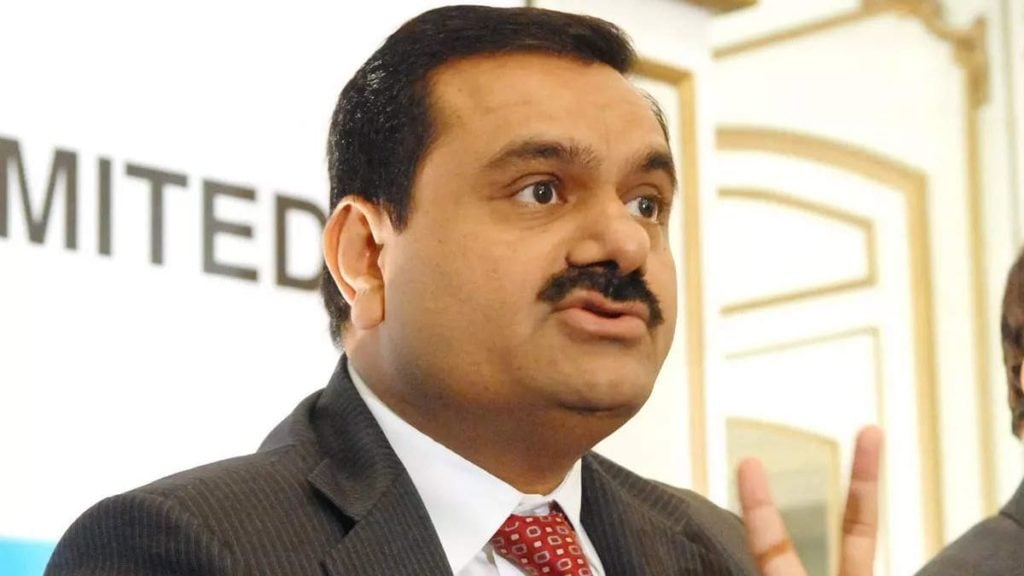

The fourth richest man in the world, billionaire Gautam Adani, has recently entered the cement, airport, and data center industries. CreditSights, a Fitch Ratings organization, is being “cautiously alert” due to the group’s aggressive objectives, the majority of which has been fueled by debt.

Adani Group and CreditSights

Fitch stated that the majority of Adani Group’s ambition for expansion is debt funded across both existing and future businesses in a report titled “Adani Group: Deeply Overleveraged.”

The worst-case scenario, according to the report, contained overly ambitious debt-funded expansion plans that might perhaps lead to a major debt trap, a distressed position, or the default of one or more group companies. The two Adani Group companies covered by their coverage, Adani Green Energy and Adani Ports and SEZ, it has kept the “Market Perform” recommendations.

The Adani company just paid $10.5 billion to purchase the cement businesses of Holcim, making it overnight the second-largest cement operator. It most recently paid $1.18 billion to acquire Israel’s Haifa port.

In addition to investing in green hydrogen, airports, highways, alumina, copper refining, data centers, and expanding its coal and PVC businesses, Adani group wants to boost its renewable portfolio by five times.

There isn’t much proof that equity capital has been added; instead, the company is dependent on bank loans, internal accruals (i.e., operating cash flows), and debt capital market funding.

A “few” instances where it attracted equity injections from other strategic or financial partners come to mind, such as TotalEnergies’ 20% share in Adani Green Energy and 25% stake in Adani New Industries.

These, however, are insignificant in light of the concerned entity’s overall capex requirements, the research claims. The corporate chairman’s personal fortune is of little consolation to the agency either.

Bill Gates has been replaced by Gautam Adani as the fourth richest person in the world. According to the article, they have seen that this is mostly connected to the value of his interests in the Adani Group equities, which have increased dramatically in recent years, and that it is paper riches.

It is challenging to estimate the family’s capacity to contribute their capital if any of the Group companies need equity injections from the promoter.

About the Ambani effect

Even though Mukesh Ambani was replaced as the richest Indian by Gautam Adani, his company is still in direct competition with Ambani in several industries, including green energy, green hydrogen, and even telecom. The research does not completely rule out the Adani group’s entry into the consumer telecom market, even though it has only obtained a 5G spectrum for its private network.

Based on the report, the two mega conglomerates in the Indian corporate sector may make some unwise financial decisions as they vie for market domination in a few new economy companies, including increasing CAPEX spending, aggressive bidding, and overleveraging.

In contrast to Adanis, Ambani’s Reliance Industries has been deleveraging over the past few years. According to CreditSights, Gautam Adani is more financially at risk due to its high levels of leverage, weak interest coverage, and cash outflows across almost all of its subsidiaries.

Adani and Modi Relation

Despite all the drawbacks, the group nevertheless has some positive aspects. The group has good ties to the government party in the country. According to sources, Mr. Gautam Adani and Mr. Narendra Modi, the Indian prime minister, are well acquainted and date back to when the latter was the chief minister of the state of Gujarat. This guarantees, at the very least, that the Adani Group’s growth ambition won’t be hindered.

Additionally, the infrastructure business is supported by favorable policy developments. In FY23, the Indian government boosted its spending on infrastructure by more than 35%, including investments in affordable housing, trains, roads, power, and telecom. All of these are served by the Adani group, which will result in more favorable growth prospects.

The Adani group has not only proven its ability to raise money both inside and outside of India thanks to the spectacular performance of all its group stocks, which has elevated it to third place in terms of value behind Reliance and Tatas.

They do find solace in the Group’s strong access to a variety of funding channels (onshore and offshore banks and capital markets), relatively stable recurring revenue-generating infrastructure assets, presence in important economic sectors, and the favorable infrastructure-favorable macro backdrop in the nation, according to the report. The group runs the risk of exceeding the “single borrower limits” set by the various banks.

Read More: XSOLLA launches pay station for mobile developers to unlock revenue with customizable checkout