In the absence of a U.S. reversal, a massive Huawei-shaped hole will open up in the global smartphone sector in 2021, posing a sales game-changer for the industry. When present stockpiles of chipsets run out due to a blacklist-induced shortfall, Huawei’s sales are expected to collapse.

This appears to be a fantastic opportunity for Apple and Samsung, but it’s in jeopardy. China Inc. believes Huawei’s formula for success can be reproduced and is working to do it rapidly.

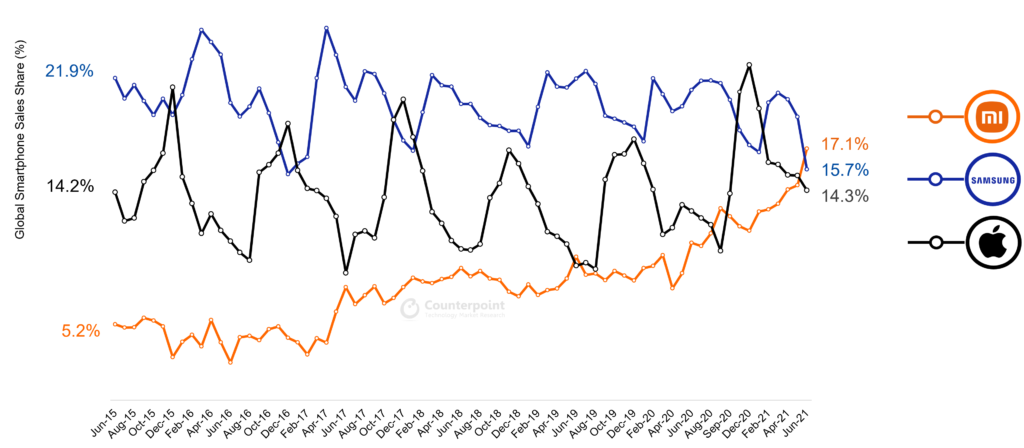

The much smaller Xiaomi was first out of the blocks to repeat Huawei’s “quality smartphones for less” strategy, beating Huawei in Europe for the first time in the second quarter of this year, with revenues increasing by 65 percent as Huawei shrank. After Samsung and Apple, Xiaomi has climbed to the third spot. Xiaomi, in particular, showed a 99 percent increase in premium device exports (€300 and higher).

Xiaomi has long been seen as Huawei’s likely Chinese export replacement, but that is about to change. Oppo, a Chinese smartphone manufacturer, is just slightly behind Xiaomi in overall global sales, but has a far greater market share in China. Oppo is another Chinese brand to keep an eye on, according to Counterpoint.

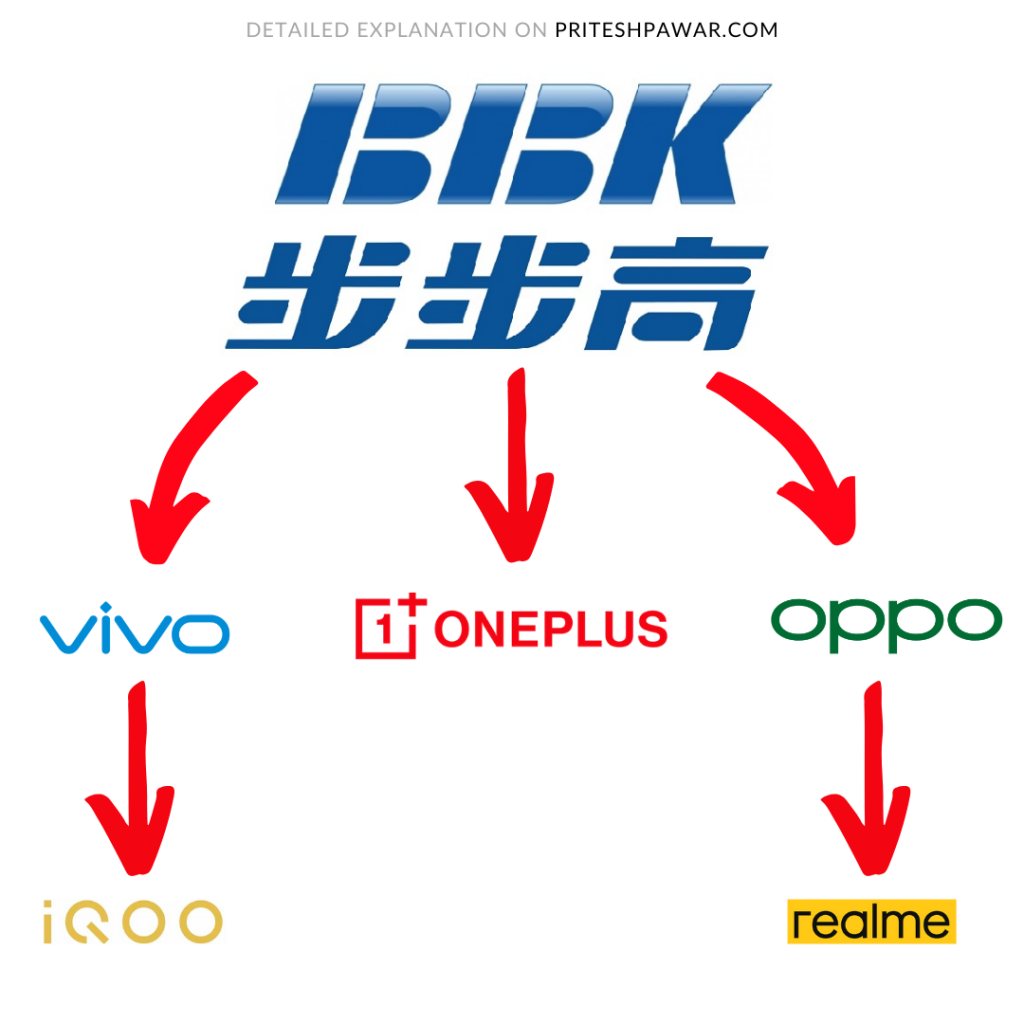

“We see players like Samsung, Apple, Xiaomi, and Oppo gaining the most as geopolitical policies and political events among states affect the smartphone market in various ways.” Oppo is a subsidiary of BBK, which also owns Vivo, and is a global competitor to Apple and Samsung.

Xiaomi, Oppo, and Vivo have chased Huawei’s relentless growth back home in China, where the company has soared as patriotic consumers respond to America’s blacklist. Huawei beat Samsung globally in the second quarter, a rare occurrence caused by China’s market recovering ahead of the rest of the world.

In China, though, Huawei had a remarkable 46 percent market share—and this was no fluke. Samsung has reclaimed the global lead, which is unsurprising. Samsung had 22 percent of the global market in August, compared to 16 percent for Huawei, according to Counterpoint.

Analysts estimate that, in the absence of a U.S. reversal, Huawei almost sold as few as 50 million devices in 2021. Even if Google were to leave, the business would expect to sell 180-200 million units. Domestic sales will account for a large portion of the reduction, as China sells 76 percent of its cellphones. However, exports will continue to fall. Huawei’s domestic competitors are now focusing on those export markets.

Some analysts believe Xiaomi might become a global top-three player as a result of its rise in Europe and its strong position in other areas, most notably India. According to Nikkei, Oppo now “aspires to have a market share of at least 5% in Europe by next year and hopes to be one of the top players in the following three years.” Oppo, which is backed by BBK, is a longer-term danger than Xiaomi.

In key sections of Europe, Oppo claims to have tripled sales this year. “However, for any smartphone maker to be considered a leader and reach that break-even point,” Alen Wu, Oppo’s worldwide sales lead, told Nikkei. In the next two to three years, we plan to achieve that target.”

Xiaomi has demonstrated that it is possible to achieve this. Ironically, Xiaomi and its BBK stablemate Vivo, who will likely ramp up exports to take advantage of Huawei’s anticipated downturn, are the most likely hurdles to Oppo’s expansion. While both phone businesses need to improve their brand recognition outside of Asia, they have had rapid growth and are now among the top worldwide sales organisations.

Huawei was in a unique position to compete with Apple and Samsung for the number one place. In reality, the moratorium has levelled the playing field for everyone else. In Europe, Xiaomi may have some brand devotion, but it pales in comparison to Huawei’s brand loyalty.

And the recent rapid growth indicates that recent converts are likely to be converted again. All of this will be clear to Oppo and Vivo, as well as BBK, which owns the OnePlus and RealMe brands and is a serious competitor to the larger global smartphone manufacturers.

Apple and Samsung, on the other hand, certainly have a large following of customers. Huawei, on the other hand, has shown that it is a viable target. When Huawei overtook Samsung in the second quarter, despite strong China sales, Canalys noted that it was “the first time in nine years when a manufacturer other than Samsung or Apple topped the market.”

Other manufacturers, most likely Chinese, must adopt the new technique as an alternative to Android in order for it to be successful. In China, this will be a plus, but in Europe and elsewhere, it will be a liability. It’s difficult to see why any OEM with a chance to target European consumers would support a competitor or make their job more difficult.

Because of Huawei’s blacklist limits, Oppo and Vivo now have access to a larger market. Huawei was able to pass Apple and now has its sights set on Samsung. Several Chinese brands are now attempting to duplicate the recipe and obtain the same results.

Clearly, these Chinese firms will fight for market dominance, with Huawei still there, albeit in a decreased capacity. However, for Apple and Samsung, the end result is an increasingly competitive market fueled by exporting Chinese manufacturers with the ability to shift the industry’s economics.

Also Read: